FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Commercial BankingSep 08 2020

-

COVID-19’s Impact on Corporate Borrowing and Credit Spreads

Author: Dale Ervin, Director, Corporate Banking and Kirsten Soneson, Director, Corporate Banking

During a financial crisis, we typically expect to see corporate debt decline as a percentage of GDP. COVID-19 has upended conventional wisdom and turned the corporate bond market on its ear. Here is what we’re seeing and how it differs from previous years.

Fed Action and Loan Availability Spurs Corporate Bond Borrowing

In wake of COVID-19 related business closures, U.S. GDP loss was 32.9% in the second quarter of 2020, and the U.S. Federal Reserve predicts an overall -6.5% contraction for the year. In an economic scenario such as this, we would expect to see borrowing as a percentage of GDP to decline, but businesses seem to be reversing the trend to survive the pandemic.

However, you won’t see a substantial increase in borrowing reflected in standard commercial loans. According to The July 2020 Senior Loan Officer Opinion Survey on Bank Lending Practices, published by the Federal Reserve on August 3, bank executives responding to the survey reported tightened credit standards on commercial and industrial (C&I) loans to firms of all sizes, with additional covenant and collateral requirements, increasing spreads and utilization of interest rate floors. It is a trend that has been in effect since April, according to the survey.

Simultaneously, demand for commercial and industrial loans declined, with more than half of banks reporting weaker demand in the second quarter, largely from smaller firms that had a declining need for M&A and inventory financing. Businesses with stronger demand for C&I loans sought to bolster their cash position or replace lost revenue. Demand for commercial real estate (CRE) debt also plummeted across all three major CRE loan categories, including construction and land development loans, nonfarm nonresidential loans and multifamily loans.

The major driver in corporate financing right now turns out to be a drastic uptick in the corporate bond market. Corporate bonds provide a way for companies to borrow from a wider array of investors with fewer conditions in place in exchange for higher, pre-determined regular interest payments.

Through late June, large U.S. companies had borrowed roughly $850 billion in the bond market this year, double the pace from 2019.[i] Much of this activity can be tied back to the Fed’s decision to lower interest rates to near zero, but a bigger inducement was the unprecedented action taken by the Fed to buy corporate bonds.

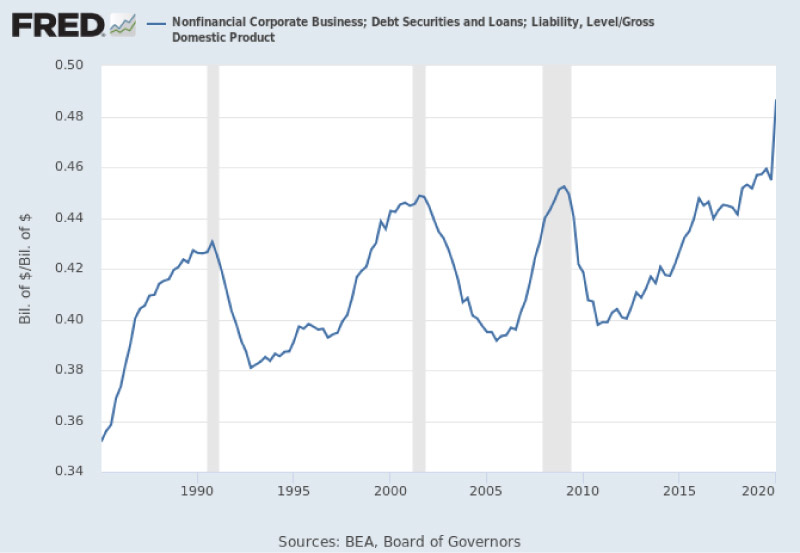

As can be seen from the chart below, which represents U.S. nonfinancial corporate debt to GDP during the most recent recessions (shaded areas), the percentage usually starts to decrease during the recession period. [ii] Leading into the current economic downturn, corporate borrowing was at an all-time high at nearly $10.5 trillion in Q1 2020 and the upward trend has persisted. The impact of this increased borrowing activity on amplifying the severity of a recession is important to monitor.

At the onset of the pandemic, the market saw a quick sell off of even high-grade bonds as investor fears rose about the ability of companies to pay on debts. In just a few days, benchmark corporate bond indices sank 5%.[iii]

To secure the bond market, the Fed announced it would buy corporate bonds in late March, initiating a flood of blue-chip deals with companies such as Nike, McDonald’s, Deere and Pfizer. Given the confidence exhibited by the Fed and the government’s virtually unlimited buying power, investors soon joined the corporate bond market in a flurry of activity that many have called historic.

Companies considered risky at the start of the pandemic, mainly those in the hotel, travel, and entertainment industries, suddenly had no trouble selling bonds thanks to enthusiastic investors seeking higher returns. Even high credit risk profile companies, including non-investment grade and junk rated bonds, such as Sirius XM Radio and Abercrombie and Fitch, issued a record $48 billion in new bonds in June.

With a run on corporate bonds, the cost of debt naturally declined, making it cheaper for corporations to borrow. As we head into the remainder of 2020, the tightening credit spread environment will be the factor to watch.

Yield Spreads and Where They are Headed

Heading into the pandemic, spreads on U.S. investment grade corporate bonds were less than 100 basis points, resulting in a 1 percentage point higher yield over treasury bonds. As COVID-19 accelerated, bond yields jumped more than 300 bps to over 400 in the span of two months.

According to S&P Global Market Intelligence, credit spreads from U.S. investment grade to high yield bonds tightened through the end of May to mid-March levels before the full onset of COVID-19, as the Fed added another $1.5 billion in bond exchange-traded funds (ETFs) to its balance sheet, edging up the total holding to $1.8 billion. The U.S. investment grade corporate bond spread was just over 200 bps on May 19, down from over 400 at the end of March, but still besting pre-COVID-19 levels.[iv] As of early August, the spread on investment grade corporate bonds sat at 140 bps.

During the same time span, high yield bonds jumped from a sub-400 bps spread before the pandemic to nearly 1,100 in mid-March before dropping back to 735 in mid-May. By the beginning of August, yields were resting at 508 bps, as low interest rates spurred investors toward higher risk assets over the near term.

To put this into perspective, the S&P Global Market Intelligence reported on July 30 that U.S. investment grade corporate bond spreads had erased 87% of the widening witnessed during the previous months and high-yield spreads had reversed 77% of the widening.

As the year comes to a close, it will be important to keep an eye on risk and volatility. On March 16, the VIX, the world's premier gauge of U.S. equity market volatility, hit an all-time high at 82.69, exceeding its peak during the Great Recession at 80.86. The VIX settled in at 29.5 on July 14, well over the 13.9 it averaged in January. Keep in mind that the overall average daily closing value for the VIX Index is 19.4. For the second quarter of 2020, the average daily closing price was 34.5, reaching the highest value for any quarter in more than 10 years.[v]

About the Authors

Dale is a Director of Corporate Banking, helping companies, municipalities and non-profits to advance their goals. He prides himself on his ability to “step into the customer's shoes” and find innovative solutions to complex financial matters. As a native Nebraskan, Dale strongly believes in the area’s potential and is proud to play a part in facilitating the region’s growth.

i “Businesses Are Supposed to Cut Debt in a Downturn. Why Not Now?” The New York Times, Jul. 20, 2020. Web.

ii Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Debt Securities and Loans; Liability, Level [BCNSDODNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BCNSDODNS, August 27, 2020. U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP, August 27, 2020.

iii “Businesses Are Supposed to Cut Debt in a Downturn. Why Not Now?” The New York Times, Jul. 20, 2020. Web.

iv “Credit Spread Tightening Accelerates but Levels Remain Heightened—Risk Monitor.” S&P Global Market Intelligence, May 21, 2020. Web.

v Matt Moran. “10 Key Features of the VIX Index and New Mini VIX Futures (VXM).” Cboe. Cboe Blogs, Aug. 10, 2020. Web.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.