Zelle®

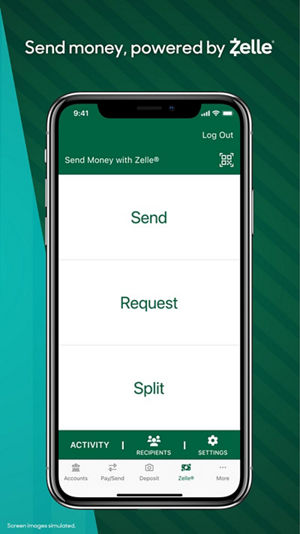

Introducing Zelle® – a fast, safe and easy way to send money to friends, family and other people you trust, even if they don't bank with FNBO1. Whether you’re paying rent, gifting money, or splitting the cost of a bill, Zelle® has you covered.

- Fast- Send money directly from your account to theirs-typically in minutes.

- Safe- Use Zelle® within the app you already trust. No account numbers are shared.

- Easy- Send money using just an email address or U.S. mobile number.

Download the FNBO App Today:

Already have our app? Start using Zelle® today to send money to friends and family:

- Login to the FNBO app.

- Select “Zelle”

- Enroll your email address or U.S. mobile number.

- You’re ready to start sending and receiving money with Zelle®.