FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

MortgageJul 21 2020

-

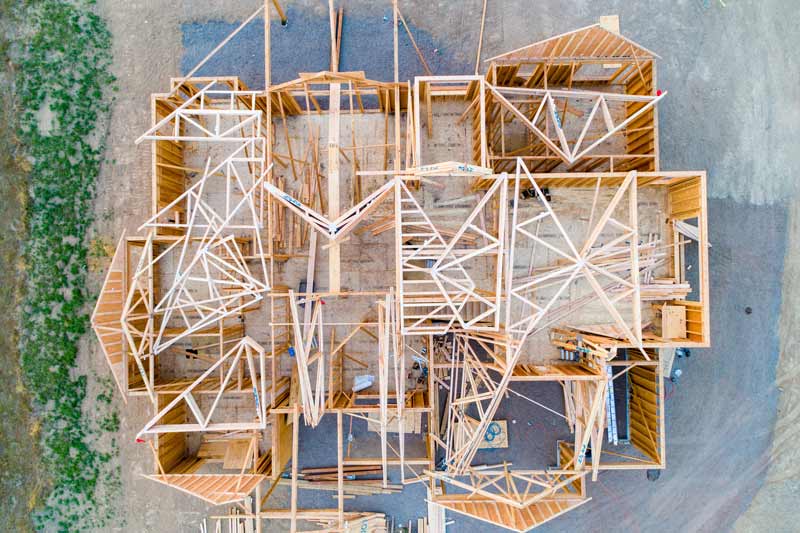

How to Get a Loan to Build a House

Whether you’ve been dreaming about it forever or just now beginning to think about building a custom home, you’re likely to have questions about financing your build and how the process differs from buying an existing home.

If that describes you, here are a some answers to the questions undoubtedly going through your mind and tips for making sure things go as smoothly as possible.

How to Buy Land to Build a House

The first thing to understand about building a custom home, is that you’ll need to purchase land to build upon. This is different from buying an existing home where the cost of the land and the home is included in the purchase price.

It also means, unless you’re able to fund the costs out-of-pocket, you’ll need to get a land or lot loan. While applying for this type of financing is similar to a mortgage application process, that may be where the similarities end.

For instance, you’ll have to say goodbye to the zero-down financing deals for which you may qualify with a mortgage. Unimproved property (an empty lot) has a lower resale potential than that of a home, which in certain circumstances, puts the lender at greater risk in the event of default.

What You Should Know Before Applying for a Land Loan

Most lenders ask for a larger down payment than you would need to get a mortgage loan. It isn’t out of the question to see a requirement of 25 percent down, or more. You may be asked to provide proof of a reserve, guaranteeing that you have money in savings to cover future payments.

Overall, lending standards are usually tighter for buying land. For example, with some lenders, a buyer looking to obtain an FHA mortgage could be approved for financing with a minimum credit score of 500, but expect that to rise to the mid-700s when borrowing for the purchase of land.

You’ll also have a shorter lending term than the standard 15- or 30-year mortgage. Lot loans are likely to only be amortized over a ten- or possibly 15-year span. There are lenders who will amortize the loan evenly over that period of time, while some will seek a large “balloon payment” as you near the end of your term.

Lastly and possibly most importantly: financing doesn’t end with the purchase of a lot. Before you can even think about pouring a foundation, you’ll need to get a construction loan to fund the costs of building your dream domicile.

What is a Construction Loan?

A construction loan is a short-term loan designed to fund expenses related to building your custom home. Here again, the application process is similar to that of a mortgage, but you’ll find a number of differences.

First, you’ll be applying for two loans. One to cover the material costs of construction, and you’ll also need to qualify for a mortgage to convert that temporary construction loan to a permanent one.

How do Construction Loans work?

The way construction loans work is also different from a mortgage. You and your builder will make requests to draw down the loan, during the construction phase, allowing your lender to make periodic disbursements to cover materials and supplies as the project progresses. During this time, you will typically make interest-only payments based on the amount drawn. Once the construction phase is complete, your lender will transition your loan into a regular, “permanent” mortgage to cover the total costs of your custom home.

Since you are applying for more than one loan, you can expect to attend multiple closings. For instance, a buyer purchasing land with no immediate plans to build will require one closing for the lot loan and a separate closing for a construction loan when they enter the building phase.

If you plan to start construction immediately after purchasing land, it is possible to close on the lot purchase and the construction loan simultaneously. In this case, there will still technically be two closings, but they will occur at the same time and place.

Starting the Process of a New Construction Loan

Given the complexities of financing a new custom build, it’s a good idea to start the process well in advance of when you intend to begin construction or buy a lot. While a conventional mortgage closes in an average of 47 days, securing a land and construction loan simultaneously could take as long as 60 days, and possibly longer.

To ensure that your plans are in line with financing available to you, it’s a good idea to get pre-approved even if you don’t have any plans/specs/budget, or even a builder! That way, you are fully prepared to discuss a realistic budget when you meet with home builders.

Unfortunately, buyer expectations are not always in line with the actual costs associated with building a new home, so it’s also a good idea to select your floor plan and get builder estimates before buying the land upon which your future home will be constructed.

How Much does it Cost to Build a House?

When calculating the cost of a new, custom home, buyers are prone to miss certain expenses, such as the cost of connecting to existing utilities, health department fees for septic and water, or even third-party testing that may be required to verify adherence to building codes. These are all factors that a qualified builder should take into account when providing a cost estimate and something for which you should be prepared.

Building a custom home is an exciting endeavor! It’s a chance to create your vision from the ground up and add those touches that bring your personality to the project. Can it be stressful? Yes. But, you can keep that to a minimum if you start early, know what you’re getting into, and work closely with your lender and builder. You’ll go from plans drawn on paper to moving into a newly-constructed house where the magic of making it your home begins.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.