FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Mortgage

Date Published: January 06, 2020

-

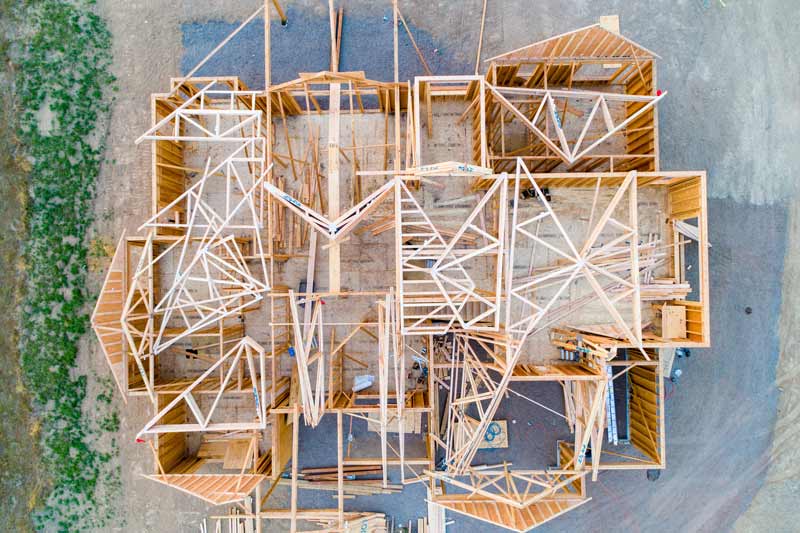

New Construction

Planning Your Dream Home? Here's a Blueprint for Success.

by Gary Voelker

“Home wasn’t built in a day.”

Anyone who has built a custom home knows the wisdom of this saying. Even before the foundation is poured or the first nail is driven, the process of choosing a builder, selecting a plan, finding the right location, and understanding all the financial and regulatory ramifications can be time-consuming…and sometimes stressful.

Just keep in mind that the rewards of owning a home—built specifically for you and your family—are immeasurable, and will last long after the dust has settled and the final touches are sparkling.

Do your homework

Better Homes & Garden reports that laying the groundwork for your custom, dream home can be years in the making, compared to the six months or so it takes to build. Allowing time upfront to put all the pieces in place will help clear the way for a smoother process.

Mortgage lenders who specialize in construction loans are an excellent source of information when it comes to navigating new-home-construction. Consulting a lender who knows how the process works, and can ascertain how much home you can realistically afford, is an important first step.

Meeting with architects and builders before you sit down with a lender isn’t out of the question, but it could result in a plan that’s outside of your budget which might be disappointing if you are forced to make more affordable choices.

“Once you’ve decided on what kind of house you want, and have consulted a lender to determine how much you qualify to borrow, obtaining an estimated cost-per-square-foot will help you figure out what you can afford,” Better Homes & Garden advises.

Financing your dream

New construction financing can involve different loan arrangements. One option is to apply for a construction loan, which the lender pays in installments to the builder as work is completed. After you move into your new home, the loan is then replaced by a permanent mortgage with an average 15- to 30-year term.

Another arrangement is for a construction-only loan, which is paid in full once construction is completed. You may want to consider this option if the sales price of your existing home will cover the cost of your new one.

When applying for either type of construction loan, be prepared to provide your lender with tax returns, bank statements, employment history and good to excellent credit scores.

Builder selection

Deciding on the style and size of the home you want to build, as well as the right contractor for the job, is another critical step in the process.

Finding a good contractor often starts with a referral from a friend or family member who has had a positive experience with a builder. It is always a good idea to include more than one contractor in your search and check their ratings and credentials with your local Better Business Bureau and homebuilder’s association. Online reviews are much more prevalent these days, and although you can’t believe 100% of everything you read on the internet, themes will emerge regarding the workmanship, customer service and reputation of home builders. Most importantly, ask questions, be direct about your expectations and get it in writing!

“Make sure you check references and find out as much as you can about the contractor’s attentiveness and style,” Inc. recommends. “Ask to see their prior work, in person. You need a contractor with a personality that complements your own. Nothing will make the process more unpleasant than a partner with whom you clash.”

Plan for the unexpected

Before work gets underway, your builder will prepare a contract, which is a written agreement that includes legal descriptions, payment terms, specifications, key dates for the project’s start and completion, penalties for delays and inferior work, as well as provisions for change orders.

Invariably, there comes a time during construction when you ask for changes or a new amenity that wasn’t included in the original specifications. It is not uncommon to have up to 10% overages in a custom-built home as a result of upgrades, such as replacing laminate countertops with granite, adding a new bathroom or finishing your basement.

Typically, you are responsible for paying overages out of pocket. Knowing that upgrades are a possibility, you need to set aside money to cover unexpected expenses. Here is another area where an experienced mortgage lender can provide project oversight, so you stay within your spending threshold.

Also, be sure that your contractor has a change order process in place, so that you understand the price difference of all modifications you request. Both parties should sign change orders, which creates a written record and can eliminate confusion should there be a dispute during or following construction.

Patience and support

The actual construction of a custom home can be a long process. It can take from six months to a year, depending upon the size of the structure, the complexity of design and unforeseen weather conditions. Various stages of external construction include excavation work and grading, exterior framing, roofing, wall installation, exterior driveways, walkways and landscaping. Interior work includes installing electrical, plumbing and ventilation systems, drywall, painting, flooring, mechanical trims and the all-important custom finishes—those personal touches that make your new construction a home.

Throughout the process, your lender will stay involved with you and your builder by conducting routine inspections and making payments (typical construction loan). An appraiser or inspector may also be retained to ensure that the project is moving along as planned.

As a homeowner, your role is to keep the lines of communication open with the builder, be the project advocate and if possible be clear about any concerns you have, but avoid confrontations over any issues you may discover.

An important last step in the process involves the final walk-through with the contractor. Be sure to closely examine every room and discuss with your builder the items that need to be finished or fixed. Make sure he/she is creating a punch list* –either written or digital—that can be shared with you after the walk-through.

It’s important to be patient and understanding, but realistic about how the project is unfolding. There will be times when the home you are building appears nothing like the vision you had, but trust that it will come together in the end. Having reliable partners on this journey can make all the difference and taking deep breaths will come in handy.

When you are taking delivery of furniture and appliances, hanging up your treasured photos and unpacking those perfectly accessorized pillows for your family room, you will start to see something magical emerge and it will all have been worth it when you build memories in your new home, sweet home.

*Punch lists consist of items such as detectable scratches or loose fixtures, or work that is discovered to be incomplete. Make sure that the builder is contractually obligated to complete all of the listed tasks before you make your final payment.

Gary Voelker is Managing Director, Mortgage Sales, for First National Bank of Omaha in Fort Collins, Colorado. His knowledge of the industry is based on nearly 15 years of practical experience in traditional mortgages and new-home construction loans.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.