FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

Andy Frahm

Director, Investment ManagementSeptember 21, 2020

-

Investing in an Election Year—What You Should Know

Author: Andy Frahm, Director, Investment Management

It‘s been said that financial markets hate uncertainty, and elections certainly bring the potential for change.

A key concern is an increased potential for downside volatility, but what should investors really be thinking about as the elections draw near, and what can they do to help safeguard investments? We’ll cover some of the common questions below and provide guidance for investing as the election draws near.

Potential Policy Changes Worry Investors

The potential for major changes to critical policies surrounding taxes, regulations and trade is a key contributor to market volatility in an election year. As an investor, it is important to understand these policies and how they could potentially impact the markets.

Joe Biden’s tax policy, for example, proposes to increase the top individual tax rate, according to Invesco U.S. Government Affairs, June 2020.[i] He also intends to implement a 39.6% long-term capital gains tax on qualified investments for high income earners and impose a 12.4% Social Security tax on income earned above $400,000.[ii] Corporations could be on the hook for higher taxes as well, with a proposed rise in the tax rate from 21% to 28% and a minimum 15% rate for companies with net incomes over $100 million.[iii]

While the potential for higher taxes can be a concern to many investors, it should be noted that major tax reform is difficult to implement. According to Invesco U.S. Government Affairs, wholesale tax reform has only happened once in the last 30 years, with the passing of the Tax Cuts and Jobs Act in 2017. As Invesco points out, it would take a Democratic majority in both the House and Senate to see another full-scale tax overhaul, such as the one Mr. Biden is suggesting.

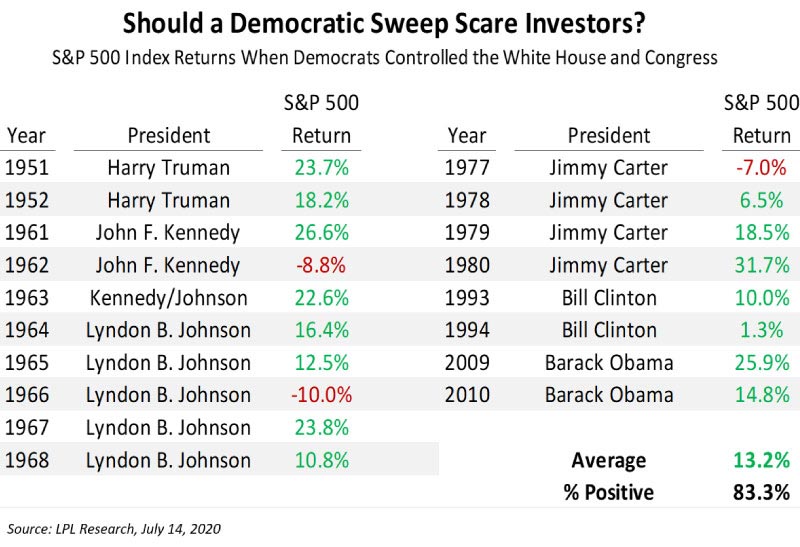

However, even in the event of a Democratic sweep in 2020, investors could still see buying opportunities, according to Keith Parker, head of global equity strategy at UBS. He believes that the prospect of higher taxes and increased regulation could drive stock prices down 2% to 5% after a Democratic sweep, since markets often overestimate the likelihood and magnitude of proposed policies, and tax increases could be less burdensome than feared. Historic precedent demonstrates a potential for high investor returns as seen in the chart below.

Mr. Parker also notes that he sees about 2% upside for the stock market in the immediate aftermath of the election if the status quo is realized—a President Trump re-election and Republicans maintaining control of the Senate. While uncertainties regarding trade policy could persist, fears of higher taxes and increased regulation would likely abate with this outcome.

Avoiding Election Year Investing Mistakes

Regardless of the potential outcomes, it’s important that investors not be driven by emotion, particularly fear, during an election year. Now is not the time to make major changes to your long-term asset allocation.

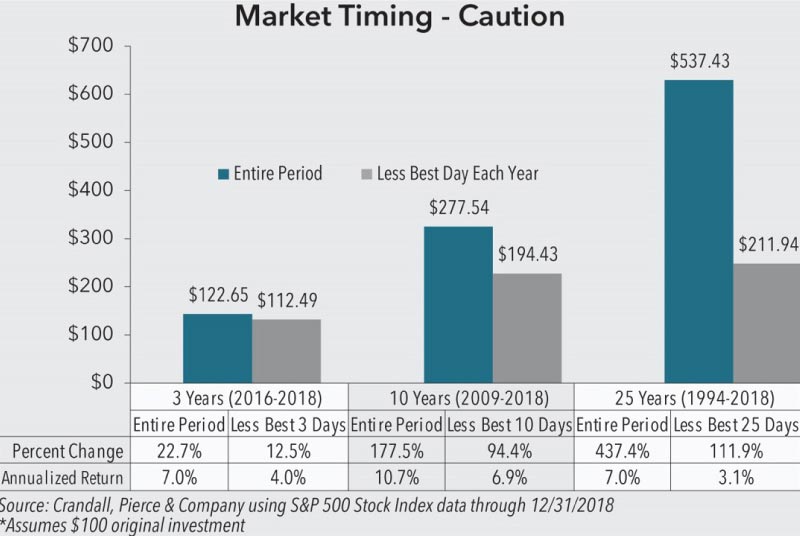

Instead, we agree with J.P. Morgan Asset Management in encouraging investors to monitor economic fundamentals, to lean toward quality in both equity and fixed income, and to maintain asset diversity. While there are no guarantees that election year concerns won’t cause market volatility, a long-term focus remains prudent. Hiding out in cash in order to miss market lows could ultimately result in a dramatic negative effect on long-term investment returns.

That’s because it is nearly impossible to time the market, as quickly became evident following the 2016 election. In the early hours of November 9, 2016, futures plummeted as election results trickled in, but markets closed on the upside once the day’s regular trading session had ended. Remember that investment time horizons extend beyond election cycles and presidential terms, so sticking to your investment plan becomes critical in an election year.

On the other hand, don’t neglect the need for ongoing rebalancing. Trimming equities may indeed make sense pre-election based upon the recent strong equity market rally, valuations, profit outlook and other economic and fundamental factors. But there is a difference between ongoing rebalancing to mitigate risk and making large, short-term shifts in asset allocation in an attempt to time the market. The latter is dangerous and rarely successful, as the market often rallies strongly, even in the midst of difficult environments.

Where election years are concerned, it may be comforting to know that the stock market has typically performed well in the year following a presidential election, regardless of whether the incumbent party won or lost. According to Fidelity Investments June Election Update, the 6-month price return of the S&P 500 index following a presidential election averaged a 3% gain if the incumbent party won. [iv] This is compared to an average 2% gain if the incumbent party lost. The analysis covered an extensive timeframe from 1936 to 2017, and also revealed that one year after a presidential election, the S&P 500 index was up almost 6% on a price basis if the incumbent party won versus up about 2.5% if the incumbent party lost.

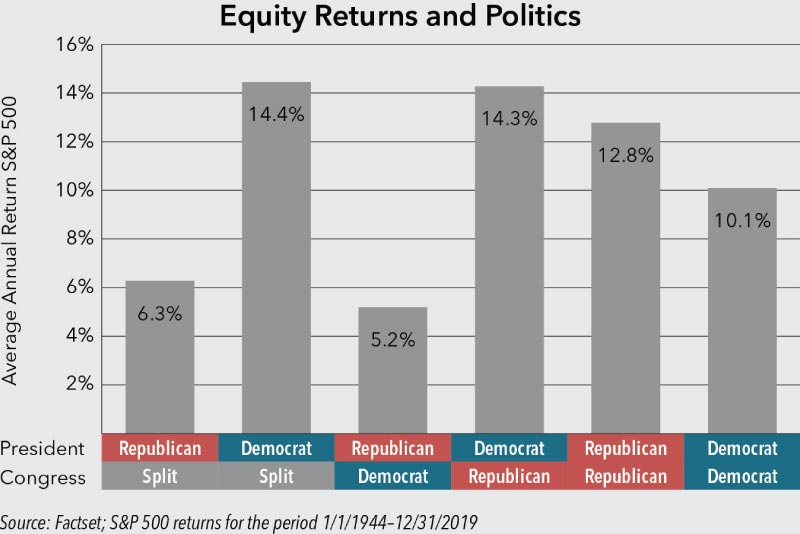

What seems to have a greater impact on market outcomes is the combination of parties in control. As demonstrated in the chart below, market performance is at its lowest when a Republican president is up against a Democratic House and Senate. Interestingly, the highest returns have been realized when a Democratic president is working with a same-party Senate but a Republican-controlled House.

Investing in 2020

The important thing for investors during any election year is to ensure that your strategic long-term asset allocation matches your long-term goals, including your time horizon, income and liquidity needs, as well as your tax situation and your willingness and ability to assume risk. It is also important to have sufficient cash on hand to meet short-term needs and to help curb the urge to respond emotionally in the event of increased volatility around the election. To keep a rational perspective, remember the points below:

10 Truths No Matter Who Wins the 2020 Election

- Markets have performed well under both parties.

- Investors are better off staying fully vested.

- The U.S. economy is not radically re-engineered following elections.

- The historical narrative is not as you remember it.

- Signature legislative accomplishments are infrequent, and the impact is not always as expected.

- Predictions tend to be wrong.

- Monetary policy matters more.

- Markets don’t care if you don’t like who is president.

- No, this is not the most vitriolic election.

- Don’t confuse partisan politics with market analysis and keep your eye on one indicator.

The overriding advice for an election year is the same as a non-election year: stay invested, don’t overact based on emotion, and stick to your long-term asset allocation. And remember, if you have questions or concerns, your financial advisor is just a phone call away.

About the Author: As a Director of Investment Management, Andy values building long-term relationships by being a trusted resource for his clients. Andy has over 23 years of investment management experience, and is responsible for managing investment portfolios for high net worth clients, institutions, foundations and endowments. He chairs the asset allocation committee and also serves on the manager research and alternative asset committees for the investment management team.

“FNBO Wealth” is a brand name that refers to First National Bank of Omaha (“FNBO”) and certain of its affiliates and subsidiaries that provide or make available trust, investment, securities brokerage, investment advisory, banking, and related services.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.