FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Commercial Banking

Date Published: June 15, 2021

-

How LIBOR Going Away May Impact Your Business

Authors: Anthony Cerasoli, Senior Vice President, Treasury & Matthew Meyer, Vice President, Corporate Banking

If your business has variable rate loans, you’ve likely heard of the London Interbank Offered Rate (LIBOR). LIBOR is a global benchmark interest rate that is published daily by the Intercontinental Exchange (ICE). Each banking day, ICE collects rate information from approximately 16 global banks and calculates the average rate these banks would lend to one another on an unsecured basis. As of December 31, 2020, financial products totaling approximately $225 trillion are tied to USD LIBOR indices.

LIBOR has been used in the pricing of many commercial banking loans and has become a hot topic in recent years, since the Fed and regulators in the U.K. announced LIBOR would be sunsetted. Banks will stop writing contracts using LIBOR by the end of 2021. The most used LIBOR rates (1M, 3M, 6M & 12M) will continue to be quoted until June 30, 2023, to allow for legacy LIBOR exposure to run-off and be replaced.

Why is LIBOR Being Phased Out?

After the discovery in the aftermath of the Global Financial Crisis (2007-2009) of manipulation by the banks which “offered” LIBOR rates, the British Regulatory Authorities mandated that LIBOR cease being used by December 31, 2021. Furthermore, the rates that the panel banks report to ICE for the calculation of LIBOR are typically not supported by actual transaction data, making it less credible than other indexes.

What Will Replace LIBOR?

In the U.S., other well-known indexes are being used to replace LIBOR. The two main indexes that will be used instead are Prime and the Secured Overnight Financing Rate (SOFR). Prime is a rate that is set by banks and is to be indicative of the rate banks would charge their most creditworthy corporate customers. It has traditionally been set at 3% above the Fed Funds target rate. SOFR references the rates set daily in the overnight Repo market. The Repo market is the market where secured lending based on U.S. Treasury bonds is executed.

FNBO is also considering Ameribor, the Bloomberg Short-Term Bank Yield Index and Fed Funds as alternative indices to LIBOR.

What if I Have a Loan Tied to LIBOR?

If your business has a LIBOR loan, expect that your financial institution will contact you regarding your loan agreement. If your loan will mature (which is the date your final loan payment is due) prior to June 30, 2023, you won’t need to change anything regarding your loan. If you have a LIBOR loan that will mature, or is set to renew, after June 30, 2023, you will have the option to switch to a different index before the maturity date, such as Prime, or you can add fallback language to your contract and once LIBOR expires, transition to a different index at that time.

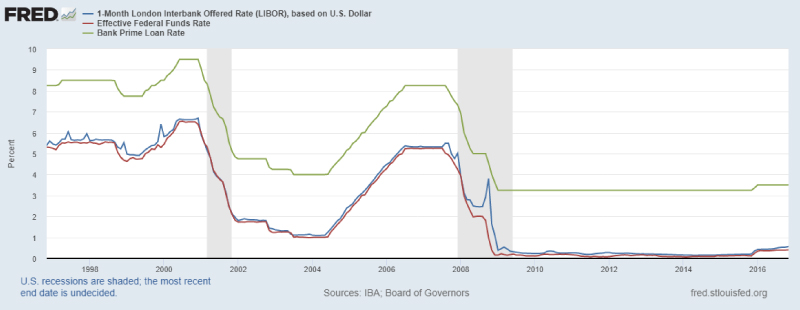

It’s important to understand how a change to your interest rate index can affect your total cost of funds. Typically, LIBOR-based loans are priced at a spread over the applicable LIBOR rate (for instance 1-Month LIBOR plus 2.00%). When switching your interest rate index to an index such as Prime, it may be necessary to apply a discount to the new index to achieve a commensurate all-in cost of funds (i.e., Prime minus 1.00%). When reviewing the chart below, you can see that LIBOR and Prime tend to correlate to each other, which has made Prime a favorable index to utilize when transitioning away from LIBOR.

FNBO will be in touch with its customers who have LIBOR indexed loans that will renew after this year. If you have questions, we encourage you to contact your FNBO Relationship Manager.

About the Authors

Anthony Cerasoli

As Treasurer, Anthony is responsible for managing the treasury function at FNBO, including the investment portfolio, asset liability risk, capital planning and stress testing. Anthony has 13 years of experience on FNBO’s treasury team and 20+ years of experience in financial services across investment management, trading, BP&A and treasury.

Matthew Meyer

Matthew partners with organizations on lending, treasury and payables solutions. He finds great satisfaction in helping clients ensure the sustainability of their organizations for years to come. Matthew first joined FNBO’s Corporate Banking Group as an analyst in 2013.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.