FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Cashology®Feb 05 2021

-

Banking Basics:

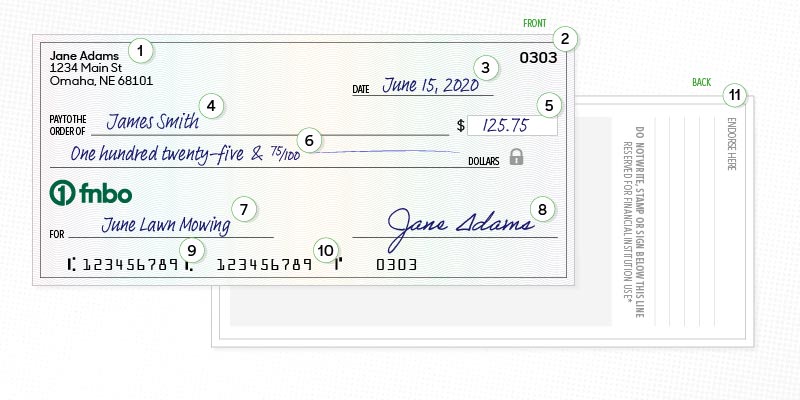

How to Read a Check

Are you a new or soon-to-be checking account holder and curious what all is included on a check? Here is a quick summary that will help inform your curious mind.

Name and Address

This is the name and address of the checking account holder and helps the bank and the payee know how to contact the account holder, if needed.

Check Number

Each check has a different number and is displayed in the top right corner and on the bottom right. This is used to help differentiate one check from another and know which check you are writing. It can also be used for tracking in the event your checkbook gets lost or stolen. You can tell your bank which check numbers are missing and your bank can watch for fraudulent checks.

Date

This is the where you write the date that the check is written and helps your bank understand when you intended to pay your payee.

Pay To The Order Of

This is the individual or organization that that you write the check to, also referred to as the payee.

Numeric Amount

Numeric amount is where you write the amount of the check using numbers/digits.

Written Amount

To help ensure your check is cashed for the correct amount, a written amount is also required. Here, you enter the dollar amount in word form to match your numeric amount.

Memo/For Line

This section is optional but can help you or your payee remember what the check was written for. For example, “June rent” or “June lawn mowing”.

Signature

This is where you sign your name to verify that you wrote the check.

Routing Number

The routing number is the string of numbers on the bottom left side of your check. It identifies your bank within the banking system.

Checking Account Number

Your checking account number is the middle set of numbers and is used to indicate to your bank the account from which the check will draw funds from.

Back Side: Endorsement Section

When you a check is written to you, this is where you sign your name when cashing or depositing the check.

Now that you know all the information included on a check, it’s time to learn how to write a check. If you have questions about opening a checking account, filling out checks or managing your checking account, a Personal Banker from FNBO would be happy to answer them. Give us a call today.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.