FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Personal Finance

Date Published: September 13, 2025Originally Published: February 03, 2021

-

Banking Basics:

How to Write a Check

Are you wondering if you’re filling out your checks correctly? Maybe you’re new to using a checking account, or maybe it’s been a while (thanks to technology) since you’ve written an actual check. No matter what the reason, following these simple steps will ensure you correctly, safely and securely write your next check.

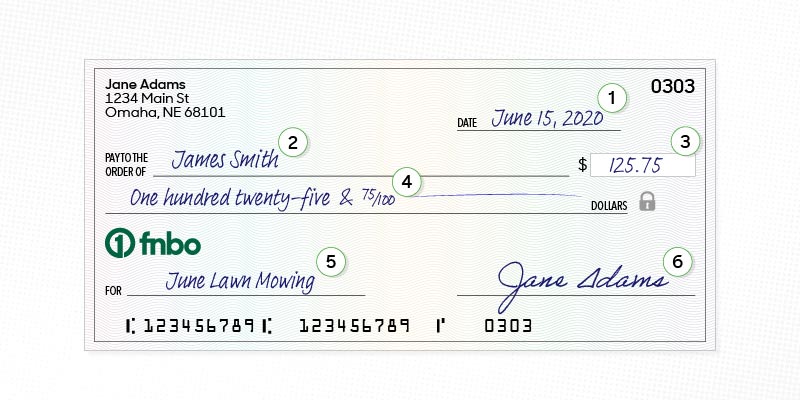

Date

This is the date you write the check and helps your bank understand when you intended to pay your payee. It’s important to include the month, day and full year.- Postdating a Check You can enter in ab future date if you need to provide someone payment in advance. For instance, if you will be out of town when your rent is due, you can provide the check to your landlord with a future date written in. This is called postdating a check and should be done only when your payee agrees not to cash or deposit your check until the actual date written on the check. However, if you do postdate a check, you should understand that although it is postdated, it can be cashed at any time, even if it’s before the date it’s written for. Make sure you have the funds in your account to cover it in the event it ends up getting cashed early.

- How long is a check good for? A Check is good for 180 days (6 months) from the date written on the check. If a check has not been cashed within that time frame, then a new check will need to be issued.

- Postdating a Check You can enter in ab future date if you need to provide someone payment in advance. For instance, if you will be out of town when your rent is due, you can provide the check to your landlord with a future date written in. This is called postdating a check and should be done only when your payee agrees not to cash or deposit your check until the actual date written on the check. However, if you do postdate a check, you should understand that although it is postdated, it can be cashed at any time, even if it’s before the date it’s written for. Make sure you have the funds in your account to cover it in the event it ends up getting cashed early.

- Pay to The Order Of This is the individual or organization that is to receive payment, also called your payee. If you are paying an individual, be sure to use the correct spelling of their first and last name. Organizations will often tell you the correct business name to write on the check. If you are unsure, be sure to ask.

- How to write a check for cash Another option is to enter “cash.” Be careful when entering “cash.” If the check gets lost or stolen and ends up in the hands of someone else, it can be easily cashed, and you could lose your money.

- How to write a check for cash Another option is to enter “cash.” Be careful when entering “cash.” If the check gets lost or stolen and ends up in the hands of someone else, it can be easily cashed, and you could lose your money.

Numeric Amount

Numeric amount is where you write the amount of the check using numbers/digits. Write the dollars in numeric form and then indicate your cents after the decimal point. In the example featured here, your dollars are one hundred twenty-five (125) and your cents are seventy-five (.75). Therefore, you enter “125.75.”Written Amount

To help ensure your check is cashed for the correct amount, a written amount is also required. Here, you enter the dollar amount in word form to match your numeric amount. In this section your cents should be written as a fraction of one hundred. If you entered “125.75” for your numeric amount, you should enter “one hundred twenty-five and 75/100” for your written amount.

If for some reason there is a discrepancy between the numeric amount and the written amount, your bank will cash the check for the written amount. Be sure the amounts in these two sections match before you give your check to your payee and you draw a line behind the amount written. For example, if you wrote “twenty five” with the intention that the check was only for 25 dollars but didn’t draw a line behind it someone could change the amount to twenty five hundred.Memo/For Line

This section is optional but can help you or your payee remember what the check was written for. For instance, if you’re paying your landlord, you could enter “June Rent” to help both of you remember which month’s rent the check was intended for. If you’re paying someone who mows your lawn, you could enter “June Lawn Mowing” to help you remember which months’s services you’ve paid for and which you have not. This also helps when you review your transactions online and can pull up the image of the check and see exactly what the check was written for.Signature

Be sure to sign your name using the same signature you used when you opened your checking account. This helps your bank ensure that you wrote the check and that it is not fraudulent.Record Your Check

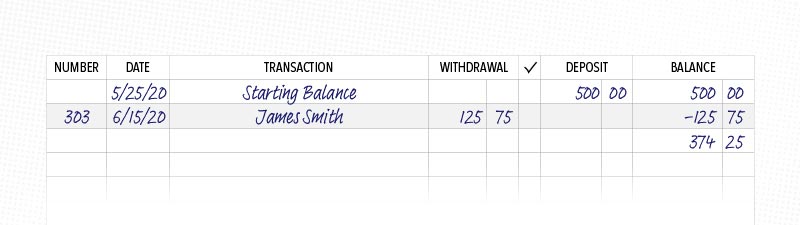

Because checks can take some time to clear your checking account (AKA be cashed), it’s important to make a note in your checkbook register or your budget indicating you wrote the check, when you wrote it, for how much and the check number. It’s easy to forget that you wrote a check, inadvertently spend the money intended to cover the check, only to have it cashed weeks later with insufficient funds in your account. This simple step could save you a lot of headaches and potential insufficient funds charges.

With a little bit of practice, writing checks becomes second nature in no time. If you continue to have questions about filling out checks or managing your checking account, a Personal Banker from FNBO would be happy to answer them. Give us a call today.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.