FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Commercial Banking

Date Published: August 27, 2019

-

How Does an Inverted Yield Curve Impact Your Business Strategy?

Author: Senior Vice President of Commercial Banking Tim Struthers

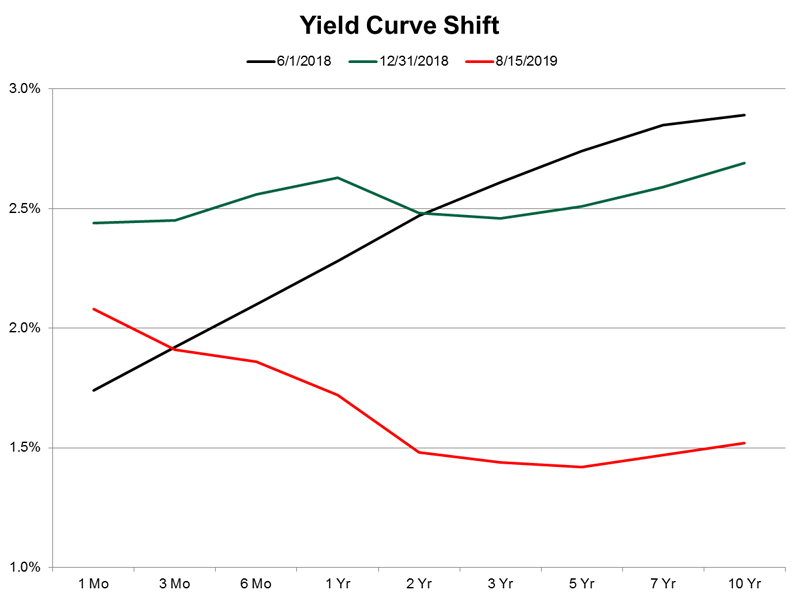

If you’re looking to grow your business in 2019 or make strategic investments, you may be hearing a lot about the inverted yield curve lately. In its simplest terms, the yield curve refers to the spread between the Treasury’s return (or yield) on short- and long-term rates. To simplify that, imagine that you want to invest excess capital. If the yields are 2 percent for a two-year bond and 3.5 percent for a 10-year bond, an upward sloping curve exists. The curve typically slopes upward due to the fact that investors require a higher return for locking up money for a longer period of time. The longer an investor’s funds are tied up, the higher the risk; therefore, a higher reward is expected.

Late last year, the difference between short- and long-term rates began to diminish. This is called a flattening or flat yield curve. More recently, the return on long-term bonds became less favorable than those associated with short-term bonds, resulting in a temporarily inverted yield curve.

An inverted yield curve may be indicative of economic headwinds or investor anticipation of a slowdown. The logic is as follows: as bond investors believe that economic growth is slowing, a rate cut from the Federal Reserve is anticipated. Due to the fact that the Fed cuts rates on the short-end of the curve, investors sell short-term bonds to hedge against reinvestment risk, which is the risk that maturing bonds will be rolled over into bonds with a lower yield. Simultaneously, investors purchase bonds with longer maturities to lock in the higher rate. Because of the inverse relationship between price and yield, this activity results in a flat or inverted yield curve, which may have an impact on your business strategy.

How Will an Inverted Yield Curve Impact Your Business Decisions?

In a business environment, a flattening or inverted yield curve may impact some of the decisions you make, particularly related to growth.

While the explanation above speaks about returns on investment, yields on Treasury bonds also have an impact on borrowing, as Treasury yields serve as a benchmark for borrowing rates. As the curve flattens, the difference between short- and long-term borrowing rates becomes narrower.

If you are looking to grow your business and need funds to buy new equipment or expand your existing buildings, a flattening yield curve means that long-term rates are now nearly as attractive as short-term rates.

If the curve inverts, interest rates over the short-term become higher than those for long-term borrowing. Many businesses find that a compelling proposition, particularly in a low-interest rate environment, because they can lock in a relatively low long-term rate.

However, when it comes to borrowing, there is no magic insight that can predict the future. In times of uncertainty, your commercial banker can help you establish a borrowing and risk management strategy that helps maximize available capital for expansion and reduces interest rate risk for all yield curve scenarios (inverted, flat and upward sloping).

Flattening Yield Curve and the Threat of Recession

You may have heard that a flattening yield curve is a harbinger of another recession. Let’s take a moment to understand that better.

As explained previously, an inverted curve generally indicates that market sentiment may be troubled. We’ve seen an inverted yield curve before every one of the last seven recessions.

Currently, economic fundamental data, such as a low unemployment rate, relatively low interest rates, robust wage growth, and positive consumer confidence suggest an economy on a firm foundation. However, due to recent uncertainties regarding tariffs, global growth, and monetary policy, U.S. economic growth may have been negatively impacted, and the inversion of the yield curve could be a signal that another recession is looming.

As a result, the Fed may reduce rates in an effort to head off a recession. According to Bloomberg World Interest Rate Probability, there is a 100 percent chance that the Fed will reduce rates at least once before the end of the year, as of August 19, 2019.

However, it’s important to remember that predicting an economic downturn is a complicated business with no-sure fire remedy. Many experts disagree on the signals and timing this time around as, in addition to raising short-term rates significantly since 2015, the Fed also continues to maintain a significant balance sheet following quantitative easing strategies during the recession, which has artificially kept maintained downward pressure on long-term rates. The quantitative easing strategies of central banks around the world were not in place prior to previous yield curve inversions, which is part of the reason that many experts believe that “this time is different”.

While nobody can predict the future, what’s important is to follow sound financial strategies. A good overarching approach in this environment is to maintain appropriate leverage levels for your business and industry, and always consider a margin of safety for downside protection if a recession should occur. As growth is facilitated by borrowing, businesses should be equally focused on mitigating lending risk.

Many of our clients follow a barbell strategy. This allows them to take advantage of the improved long-term rates of an inverted curve for larger purchases, such as real estate or equipment.

For revolving lines of credit, businesses tend to float on the short end of the curve. Since interest rates for short-term borrowing are generally priced off of Prime and LIBOR, they will change according to Fed rate adjustments.

We can understand this better by looking back over the last four years. From 2015 to the present, the Fed raised interest rates nine times and cut rates one time, resulting in a net 2.0 percent increase to the Fed Funds rate, which is a benchmark for short-term borrowing. However, during the same time period, the 10-year U.S. Treasury yield decreased .65 percent (from 2.24 percent to 1.59 percent). As a result, some businesses found themselves in an unusual position where their short-term revolving line of credit rates were higher than long-term financing rates for equipment, real estate or other assets.

If the Fed lowers interest rates, businesses will benefit from falling interest expense on revolving lines of credit. Over time, we are likely to see an adjustment, where short-term rates fall below those at the longer end of the curve, resulting in an upward sloping, or “normal”, yield curve.

Taking a barbell approach allows you to mitigate risk by taking advantage of favorable rate changes over the short-term. On the other hand, money borrowed over the long-term will remain locked in at the historically low long-term rates.

Preparing for a Sound Financial Future

As you consider your business plans and the impact of the current economic environment, it’s important that you make the right decisions for your unique situation. Your commercial banker can work with you to fine-tune your strategy and help you to remain financially stable during economic ups and downs.

About the Author

Tim Struthers

Tim is the Senior Vice President of Commercial Banking. He oversees the bank’s business in eight markets, crossing five states and 35 towns. He believes First National Bank of Omaha is a “great, big, small bank” and is pleased to help facilitate this mission.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.