FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO Newsroom

Date Published: November 14, 2023

-

FNBO Releases 2023 ‘Personal Finance Perspectives’ Survey

OMAHA, Neb. November 14, 2023.– FNBO (First National Bank of Omaha) today released the results of its 2023 Personal Finance Perspectives Survey. The latest in a series of consumer surveys by FNBO, the 2023 Personal Finance Perspectives Survey spans a wide range of topics – from saving and budgeting to financial planning to the impacts of the economy on consumers’ mental health and wellbeing.

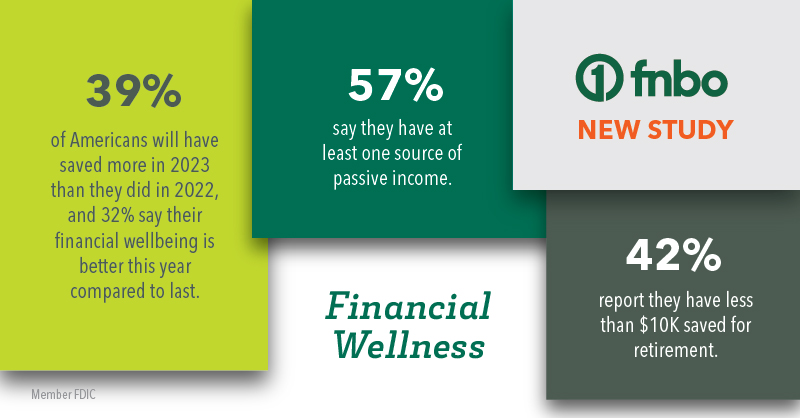

The survey found that 39% of Americans will have saved more in 2023 than they did in 2022, and 32% say their financial wellbeing is better this year compared to last. Meanwhile, 65% of Americans say thinking about personal finance is a significant source of anxiety for them.

“As we wrap 2023, and look ahead to 2024, there remains a sense of economic uncertainty – which consumers are doing their best to navigate through. This survey reveals the mindset and circumstances of consumers across America,” said Nathan Ewert, Senior Vice President at FNBO. “At the core of any successful personal financial strategy: financial literacy, budgeting and planning ahead. At FNBO, we strive to help provide the knowledge, resources and opportunities that pave the way to financial success.”

Additional findings include:

- SAVINGS: 57% of Americans say they are living paycheck to paycheck, and 56% of report that they have an emergency fund that is worth at least 3 months of expenses. Additionally, 57% say they have at least one source of passive income.

- DEBT: 47% report that their monthly expenses exceed their monthly income. Plus, 44% of Americans with debt say it hinders progress towards achieving personal goals.

- RETIREMENT: 42% report they have less than $10K saved for retirement.

- FINANCIAL LITERACY: 97% believe financial literacy should be taught in schools. Additionally, nearly 40% say their parents did a poor job of teaching them about personal finance.

- FINANCIAL SOURCES: When asked about where they get their financial information, 41% of respondents said from a spouse/family member, 41% say from personal finance websites/blogs, 32% say from bank websites, 28% say from a financial advisor, 24% say from YouTube, 20% say from Facebook, 17% say from TikTok and 12% say from Twitter.

This is the latest survey in FNBO’s Consumer Financial Trends series.

METHODOLOGY

This survey was conducted online using Survey Monkey among a national sample of 1,086 adults spanning across U.S. geographic regions and income levels. The survey sample was weighted to reflect the gender distribution and the age distribution across the 18-44 and 45+ age brackets in U.S. census data.

About FNBO

First National Bank of Omaha (FNBO) is a subsidiary of First National of Nebraska, Inc. (FNNI). FNNI and its affiliates have over $30 billion in assets and 5,000 employee associates. Primary banking offices are located in Nebraska, Colorado, Illinois, Iowa, Kansas, South Dakota, Texas and Wyoming. Founded in 1857, FNBO has maintained its commitment to helping build strong communities for more than 165 years. Learn more at FNBO.com and connect with us on Facebook, X and Instagram. Member FDIC.

For information contact:

Sally Christensen

402-871-1933

schristensen@fnbo.com

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.