FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

Clint Sporhase

Vice President, Business BankingSep 16 2019

-

Utilizing the Option to Outsource Tasks

As a small business owner, you typically wear many hats representing every aspect of your organization, from managing cash flow to the smallest tasks, including chief cook and bottle washer. Eventually, it may become advantageous, or necessary, to hand off one or more of those hats to someone else to free up your time to focus on more productive tasks.

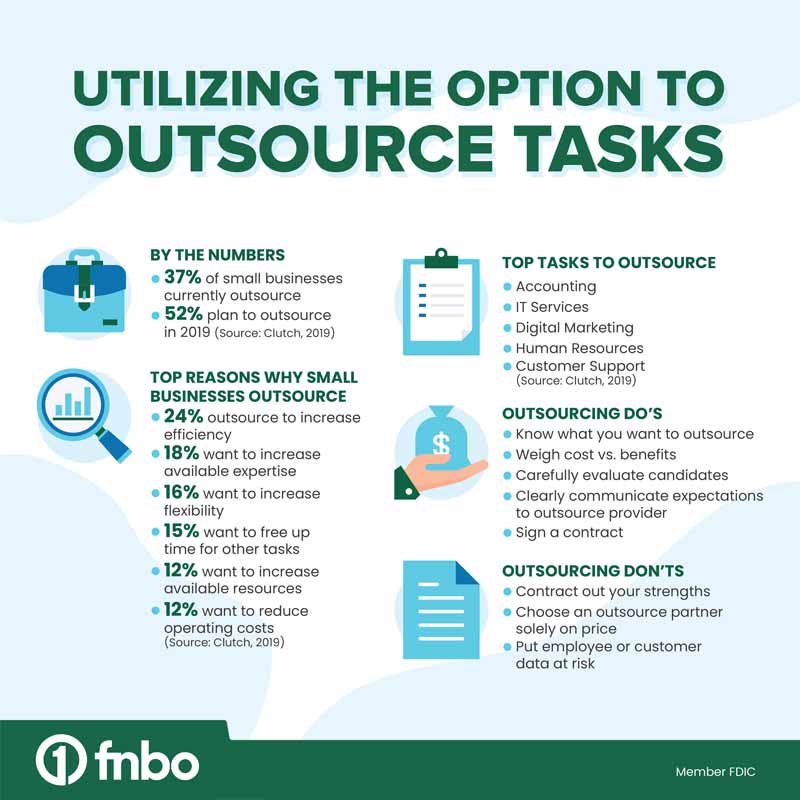

In a Clutch survey of 529 U.S. small business owners and managers released this summer, more than half (52 percent) reported plans to outsource a business process in 2019 – compared to 37 percent of small businesses that outsourced in 2018.

The most commonly outsourced tasks identified in the survey were accounting (37 percent), IT services (37 percent) and digital marketing (34 percent).

You may also choose to outsource tedious or repetitive tasks that zap your energy and take up valuable time that you could better spend on business development, creating more value for your company, or improving your work-life balance to allow more time with your family and friends.

When to outsource

Your decision to outsource may arise from a lack of expertise in a highly skilled business process or out of necessity in the event of a key employee getting sick or hurt and unable to work for an extended period.

If you are in the early stages of a business, outsourcing can help you from becoming overwhelmed by tasks outside your area of expertise and avoid large expenditures. As the business matures, demands on your time may require a fractional or outsourced chief financial officer to help you with oversight of bookkeeping and strategic planning.

Small business owners are also adopting innovative technologies that can enhance customer experiences. Software packages such as Quickbooks allow contract accountants to access a company’s financials remotely with the owner’s permission. Digital payment services for small businesses are also available to help you save time and get paid faster.

Outsourcing risks

Contracting tasks to an outsource provider may expose a small business to security risks such as financial fraud, skimming, embezzlement of inventory or theft of proprietary information. Loss of capital or sensitive data from outsourcing can jeopardize operations and damage a company’s reputation with customers and vendors.

By conducting thorough background checks that span the entire work history of an outsourced provider, you can eliminate questionable candidates from consideration. In-depth due diligence is especially important when you are considering candidates for sensitive positions involving financial records.

Your network of certified public accountants, attorneys and bankers, as well as business and trade associations, are often a good source of referrals for qualified individuals or firms that specialize in outsourcing. The Small Business Development Center and SCORE, a resource partner of the U.S. Small Business Administration (SBA), are possible sources of C-Suite outsourcing referrals.

You can also prevent outsourcing from becoming a liability by restricting data sharing to the bare minimum required by the outsource contractor and by providing adequate oversight to ensure that work is done on time at the level the business is expected to perform.

Outsourcing rewards

Increasing efficiency and available expertise were among the top reasons for outsourcing cited by small business owners in the Clutch survey, followed by increasing flexibility and freeing up employees’ time for other tasks.

Outsourcing is a proven strategy for bringing in experienced professionals without incurring the expense of full-time employees. With outsourcing, you can reduce labor costs and overhead to give your company a competitive advantage over competitors who are saddled with fixed payrolls.

In weighing the risks vs. rewards of outsourcing, small business owners can fall into a trap by focusing on the expense of outsourcing instead of its value. When viewed objectively, outsourcing offers numerous advantages that can help you transition from peripheral activities to focus your time, energy and resources on the important task of growing your business.

About the Author: Clint Sporhase leads First National Bank’s efforts to serve small business owners. Clint has 25 years of sales, marketing and strategy experience.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.