FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

Barbara Rizvi, CFP®

Director, Financial Planning

Date Published: May 10, 2023

-

Article | Read time: 6 minutes

Author: Barbara Rizvi, Director of Financial Planning

Whether retirement is years away or just around the corner, understanding the tax differences between traditional retirement accounts (such as IRA, 401(k), 403(b), etc.) and more recent Roth retirement accounts (such as Roth IRA, Roth 401(k), Roth 403(b), etc.) can have a material impact on the purchasing power of your retirement nest egg. If you don’t know the difference between the two, let’s break it down.

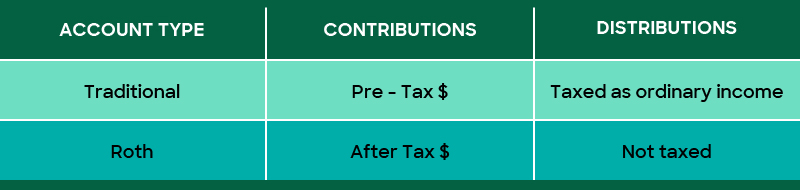

Fundamental Tax Differences

With a traditional retirement account, you contribute to your retirement using pre-tax dollars and defer paying income taxes on the money until you withdraw it during retirement. This means contributions to traditional accounts are taken off the top of your paycheck before taxes are assessed. But when you withdraw money during retirement, the IRS collects taxes on the income you’ve been allowed to defer, so you pay income taxes on every dollar withdrawn (your initial investment as well as the growth).

The advantage of a traditional retirement account is that your contributions reduce your amount of taxable income now. The disadvantage is that your withdrawals increase your taxable income in retirement.

Conversely, with a Roth account, you contribute to your retirement using after-tax dollars but withdrawals during retirement are tax-free. This means contributions to Roth accounts are made after income taxes are assessed from your paycheck. Because you have already paid income taxes on the contribution, the IRS allows you to grow and take retirement withdrawals free of income tax (you are never paying taxes on the growth).

The advantage of a Roth retirement account is that you have tax free withdrawals during retirement. This disadvantage is that contributions do not reduce your amount of taxable income now.

But Taxes Make My Head Spin!

Both a Roth and a traditional retirement account can be used to help you save for retirement. Where you will realize the biggest benefits largely depends on your tax situation now and what you expect after retirement. Let’s look at a few examples.

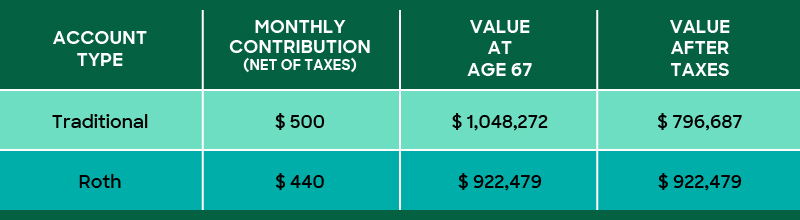

Megan is 30 years old and single. Her current income places her in the 12% federal tax bracket. With $5,000 a month gross salary, she wants to save 10% of her salary ($500/month) and retire in 37 years. Assume an annual investment return of 7% and her projected federal tax bracket in retirement to be 24%.

Given these factors, if Megan contributes to a traditional retirement account, she will contribute the full $500 per month (contributions are pre-tax) and have over $1 million saved at retirement. If Megan contributes to a Roth account, she will contribute $440 per month ($500 less 12% income tax withheld) and have just over $900,000 saved at retirement.

At first glance, it appears Megan would realize greater outcomes with a traditional account because the value at age 67 would be $125,793 greater than that of the Roth account. However, because her income tax bracket in retirement (24%) is projected to be higher than her current tax bracket (12%), the $1,048,272 in her traditional IRA will only provide her with $796,687 after taxes are withheld at 24%. Her available funds after retirement would decrease $125,742 by investing in a traditional retirement account.

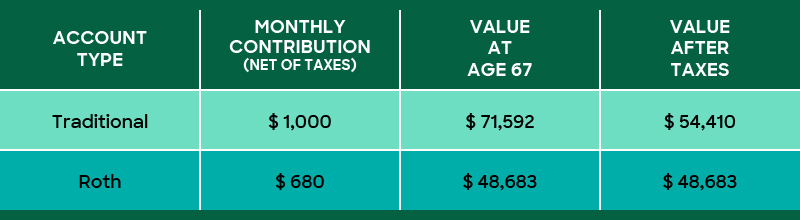

Here is another scenario, this time demonstrating the value of a traditional retirement accounts. Marianne is married and 62 years old. She is currently in the 32% federal tax bracket, making $10,000 gross a month. She is saving 10% ($1,000/month) in a traditional IRA and plans to retire in five years, at which time her projected federal tax bracket will be 24%, assuming an investment return of 7%.

Because contributions to a traditional account are pre-tax, Marianne is investing the full $1,000 into her account each month. If she were putting post-tax contributions into a Roth account, Marianne would only be investing $680 each month ($1,000 less 32% income tax withheld).

When Marianne turns 67, the value of her traditional account will be $22,909 more than if she had invested in a Roth account. But what about the impact of taxes on distributions? Because Marianne’s income tax bracket in retirement (24%) is projected to be lower than her current tax bracket (32%), the $71,952 in her traditional account will provide her with $54,410 after withholding 24% in taxes as compared to $48,683 in the Roth. As a result, using the traditional pre-tax contributions for her retirement savings is a better option for Marianne.

Other Factors to Consider

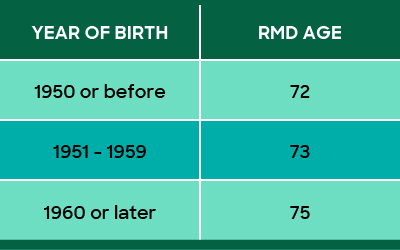

RMDs: Traditional retirement accounts have required minimum distributions (RMDs), meaning the IRS mandates individuals withdraw a minimum amount from traditional retirement accounts each year. RMDs allow the IRS to begin capturing taxes on previously untaxed contributions and investment growth. For many people this isn’t problematic, as they will be withdrawing more than their RMD amount to meet annual income needs during retirement. However, for those with sizeable retirement nest eggs or other sources of income during retirement, RMDs can result in unwanted taxable income. Current law (SECURE ACT 2.0 as of December 2022) states RMDs must begin at:

Roth accounts do not have RMDs during the account owner’s lifetime because the IRS already collected taxes on the initial contributions. Because there are no RMDs, the investment can continue to grow for a longer period with minimal tax implications.

Tax Diversification: While a Roth account is an excellent instrument for those expecting to be in a lower tax bracket during retirement, some choose to save in Roth accounts even when their current tax bracket is higher than projected in retirement. Typically, this would be individuals who previously did not have access to Roth accounts when their tax bracket was lower and who are now seeking tax diversity amongst their retirement assets. Another common scenario is someone who anticipates leaving a material amount of their retirement assets to their children and would like for the children to inherit those assets tax-free.

Charitable Intent: Qualified charities do not pay taxes on donations received from traditional retirement accounts. Because you did not pay taxes on the contribution and the charity does not pay taxes on the donation, traditional retirement assets are the most tax efficient asset for charitable giving during retirement or at death.

At the end of the day, you have many retirement savings options. Whether you should invest in a Roth or traditional retirement account depends on your income now and future earning potential. Be sure to sit down regularly with a wealth management professional who can help you make the right choices for your situation now as well as when you retire.

There are different eligibility restrictions and contribution limitations for traditional IRA, Roth IRA and employer-sponsored Traditional and Roth 401(k), 403(b)s, etc. Please work with your financial or tax advisor to understand which options are available to you.

Examples are hypothetical for illustration purposes only. Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Like Traditional IRAs, contribution limits apply to Roth IRAs. In addition, with a Roth IRA, your allowable contribution may be reduced or eliminated if your annual income exceeds certain limits. Contributions to a Roth IRA are never tax deductible, but if certain conditions are met, distributions will be completely income tax free.

About the Author

Barbara Rizvi is a Financial Planner with the Private Client Advisory and Financial Planning teams within the Wealth Management group at First National Bank. She holds the CERTIFIED FINANCIAL PLANNER™ certification and is a Chartered Financial Consultant (ChFC®). She specializes in providing comprehensive and personalized financial planning that incorporates investment, retirement, tax, protection and estate planning strategies.

“FNBO Wealth” is a brand name that refers to First National Bank of Omaha (“FNBO”) and certain of its affiliates and subsidiaries that provide or make available trust, investment, securities brokerage, investment advisory, banking, and related services.

This material is provided for informational purposes only. It does not constitute legal, tax, accounting, or other professional advice. It is subject to change without notice. Information contained herein from third-parties was obtained from sources considered to be reliable. However, its accuracy, completeness, or reliability is not guaranteed. Linkage to any third-party content is for informational purposes only and in no way implies an endorsement or affiliation of any kind with any third-party. FNBO bears no responsibility for any third-party sites or content. This material was created as of the date indicated and reflects the author’s views as of such date. Neither the publisher nor any other party assumes liability for any loss or damage due to reliance on this material.

FNBO and its affiliates do not provide tax or legal advice.