FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO Newsroom

Date Published: August 03, 2020

-

Press Release

Release Date: August 3, 2020

First National Bank of Omaha and Ford Launch New FordPass™ Rewards Visa® Card

Credit Card is Newest Feature of Most Comprehensive Loyalty Rewards Program in Auto Industry

OMAHA, Neb. August 3, 2020—First National Bank of Omaha (FNBO) announced today the launch of a new automotive credit card program with Ford Motor Company and Visa, Inc. FNBO is among the nation’s leading and most experienced credit card issuers, partnering with a broad range of world-class companies.

The FordPass™ Rewards Visa® Card enables customers to earn points not only through Ford dealership purchases, but also when paying for gas, auto insurance, tolls, parking, dining and all other purchases. The credit card is the next step in the company’s journey to strengthen customer loyalty following the launch of its FordPass Rewards program last year. As the most comprehensive loyalty rewards program in the industry, FordPass Rewards already has more than four million active members in its first year.

“This collaboration brings together three companies who are pioneers in their respective industries to deliver a truly outstanding credit card,” said Jerry J. O’Flanagan, executive vice president, Consumer Banking, at FNBO. “Following the introduction of the FordPass Rewards loyalty program last year, Ford continues to see increased enrollment month over month, which is a testament to the brand loyalty of its customers. We look forward to further enhancing that experience with the introduction of the FordPass Rewards Visa Card.”

FordPass Rewards Visa members earn the most points when using the card for purchases at Ford Dealership service centers. Points may be used toward the purchase or lease of a customer’s next Ford vehicle or for Ford service and parts.

“Building trust and delivering the best ownership experience possible for our customers is our top priority at Ford,” said David Loflin, Manager, Customer Experience. “Not only does this card match the features of other major players in the credit card space, it offers customers a means to reduce the cost of ownership by redeeming Points to purchase, lease or service their vehicle.”

Other benefits of this card include member exclusive benefits aimed at making customers’ lives easier, such as the recent offerings of free maintenance packages for essential workers and one month of complimentary Postmates delivery services.

“Visa is delighted to partner with Ford Motor Company to expand its customer loyalty program with the new FordPass Rewards Visa Card,” said Kirk Stuart, senior vice president, head of North America Merchant, Visa. “The FordPass Rewards Visa Card enhances the Ford customer experience through everyday purchases that deliver added rewards, benefits and value.”

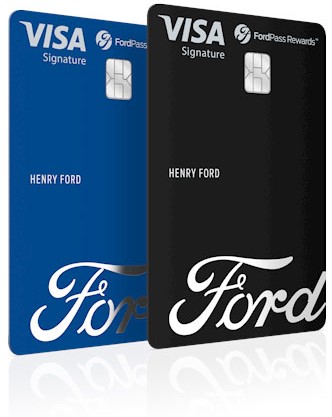

At launch, the FordPass Rewards Visa Card will be available in Model-A Black and Blue Oval Blue. Beginning with the Bronco brand and the all-new Ford F-150, future iterations of the card will allow for customization, which will eventually be expanded to include other vehicle models.

To learn more about the FordPass Rewards Visa card and to apply, visit FordPassRewards.com/Visa.

About Ford Motor Company

Ford Motor Company is a global company based in Dearborn, Michigan. The company designs, manufactures, markets and services a full line of Ford cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides financial services through Ford Motor Credit Company and is pursuing leadership positions in electrification; mobility solutions, including self-driving services; and connected services. Ford employs approximately 188,000 people worldwide. For more information regarding Ford, its products and Ford Motor Credit Company, please visit www.corporate.ford.com.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.