FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

Kurt Spieler

Chief Investment Officer

Date Published: March 02, 2020

-

Market Downturn from Coronavirus – What Investors Should Do

Author: Kurt Spieler, Chief Investment Officer

Last week, global equities fell sharply due to the spread of the COVID-19 coronavirus from China into other countries, including the U.S. The S&P 500 experienced its largest one-day decline since 2011, and entered a correction (> 10% decline) in only six trading days.[i] The S&P 500 is off -12.7% from its peak on February 19th and is down -8.3% year-to-date through February 28th.[ii]

What is causing the panic selling? Essentially, it’s fear of the unknown. Coronaviruses are a large family of viruses that can cause respiratory illnesses with symptoms that include fever, cough and shortness of breath. At this point, the medical community can’t tell how far this strain, COVID-19, will spread or when a vaccine will be available. World Health Organization (WHO) officials recently said they are increasing the risk assessment of the coronavirus to “very high” across the world. At FNBO, we are concerned with the global suffering that so many have endured and offer condolences to the families impacted.

We understand you may be anxious about the market downturn; here are our thoughts on what investors should do.

FNBO Perspective on Stock Market Volatility

Short-term corrections typically occur every year. The average downturn of the S&P 500 in a calendar year is 14% since 1980.[iii] Even though the last week has been painful, we are only closing in on “average” levels.

Many investors cite the market experience during other coronaviruses, like MERS-CoV and SARS-CoV. These viruses caused outbreaks internationally and have been known to cause severe illness. The S&P 500 fell 15% after SARS hit the market in 2003 and recovered the losses six months after the outbreak began.[iv]

Investing in equities can be volatile, but history shows the odds of achieving a positive return increase with a longer time horizon. The S&P 500 return is positive 77% of the time over a one-year period. The percentage of positive returns increases to 97% over 10 years.[v]

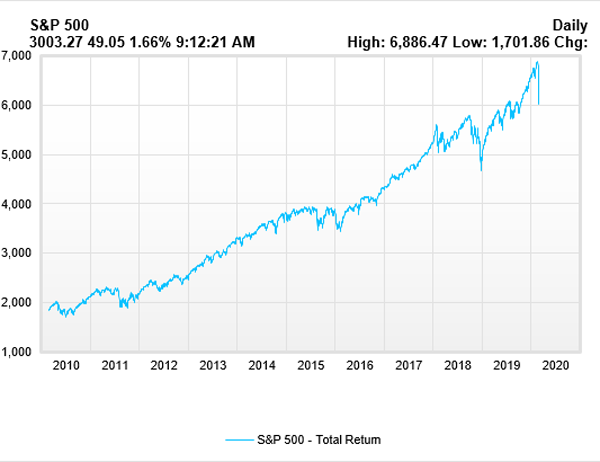

Lastly, investors benefit from staying invested during these volatile periods. As illustrated, the S&P 500 is up 229% over the last 10 years, even with the almost 13% recent decline.[vi]

FNBO Perspective on Bond Market Volatility

Fear over the spreading coronavirus has sparked demand for safe-haven fixed income securities. The 10-year Treasury yield has dropped from 1.92% at year-end to 1.15% as of February 28th.[i] Long maturity interest rates in the U.S. are at all-time lows.

For investors with a core fixed income allocation, positive returns have partially offset the negative equity market.

Global Economic Impact

The economic implication of coronavirus is difficult to determine at this point. We are aware of the negative impact in industries tied to tourism, international trade and the ongoing disruption in global supply chains. Whether this global economic shock is short-term or transitory is a major question facing the global economy.

Major companies, such as Apple and Microsoft, have provided information on the potential negative impact to their outlook. As a result of the economic ramification, Wall Street has begun to reduce expectations for economic activity and have lowered their expected earnings growth in 2020.

On Friday, February 28th, Federal Reserve Chairman Powell called the U.S. economy “strong” but said the coronavirus “poses evolving risks to economic activity.” He stated the Fed would use its monetary tools to support the economy. Bond market futures put the odds around 90% on the central bank cutting rates at least two times before year-end.[viii] Monetary policy could help alleviate the financial burden on companies experiencing supply and sales disruptions but would have limited impact on creating demand for goods and services.

What Investors Should Do

We stated in the 2020 Outlook that investing based on politics is not a sound investment strategy. Similarly, panic is also not a sound investment strategy! There are many historic instances that show patient, long-term investors do well whereas panic-induced trading rarely pays off.

For investors with diversified portfolios and an asset allocation approach designed to meet return/risk objectives, we believe the best strategy is to stay the course. Markets may yet experience a deeper correction due to the coronavirus outbreak, but trying to time the market is rarely successful.

At FNBO, we strive to take advantage of market volatility and make investment decisions designed to add incremental returns. In uncertain times, we welcome the opportunity to meet with you to review your long-term plan and changes we are making in portfolios.

About the Author

Kurt Spieler is Chief Investment Officer for First National Bank Wealth Management, where he is responsible for developing and implementing investment strategies. This includes leading the asset allocation, equity, fixed income and manager research committees. In addition, Kurt manages investment portfolios for high net worth and institutional clients.

[i] Wall Street Journal

[ii] Bloomberg

[iii] First Trust

[iv] Barron’s

[v] First Trust

[vi] Bloomberg

[vii] Bloomberg

[viii] Wall Street Journal

“FNBO Wealth” is a brand name that refers to First National Bank of Omaha (“FNBO”) and certain of its affiliates and subsidiaries that provide or make available trust, investment, securities brokerage, investment advisory, banking, and related services.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.