FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Personal Finance

Date Published: August 27, 2025Originally Published: April 15, 2021

-

Article | Read time: 3 minutes

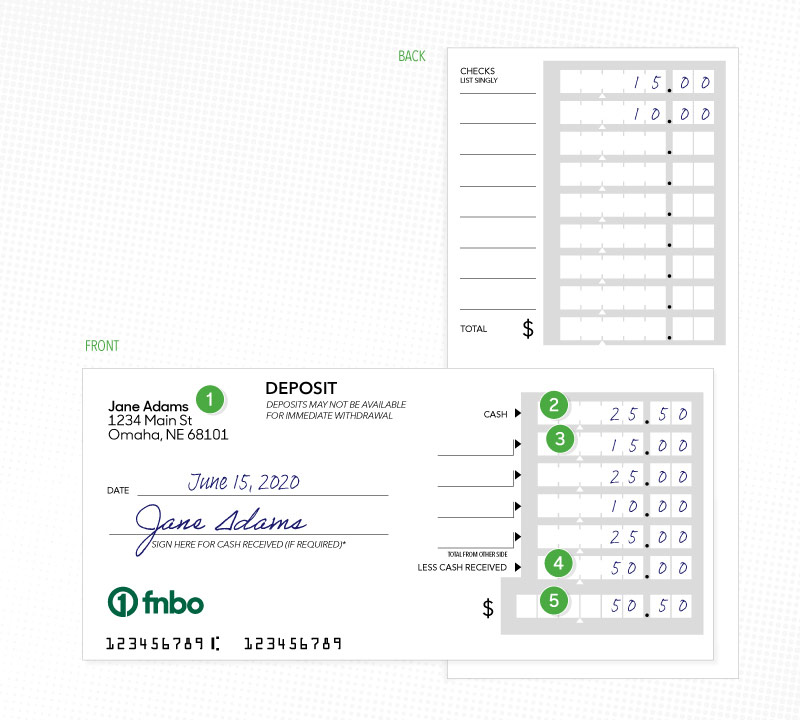

Have you recently been given some cash that you want to deposit into your bank account for safekeeping? To make a deposit at your bank, you will need fill out a deposit slip. Learn the correct way to fill out a deposit slip to ensure your trip to the bank is quick, easy and your money is accurately deposited into your account.

If you have a checking account or money market account, you may have some deposit slips in the back of your checkbook. If not, you can obtain a generic deposit slip at your bank branch. Before handing your deposit slip to your teller or banker, you should be sure the following information is filled in:

-

Personal Information

If you have your own deposit slips, your personal information will likely already be printed on your deposit slip. If you are using a generic deposit slip, you will need to fill in the date you are making the deposit, as well as the name on the account and account number of the account you wish to deposit money into on their respective lines. If you don’t have the account number, a teller will be able to look it up with your ID and/or debit card.

-

Total Cash Amount

When depositing cash, you need to enter the exact amount of cash you will be depositing on the line labeled “cash”. Cash includes the total of all paper currency and coins you wish to deposit. For example, if you deposit a twenty-dollar bill, a five-dollar bill, and two quarters, you will enter “25.50” on the cash line.

-

Total Check Amount

If you have checks to deposit, simply list the amount of each individual check on the lines underneath the “Cash” line. If you run out of room on the front of your deposit slip, there are usually additional lines on the back. Be sure to list the total amount of checks detailed on the back side of the deposit slip in the section titled “total from the other side”. For example, if you have five checks in the amounts of $15, $25, $10, $15, and $10, you will enter the first three on the front ($15, $25, and $10) and the remaining two on the back ($15 and $10). Your “total from the other side” will equal $25. Need help with how to fill out checks? Learn more here.

-

Less Cash Received

In some instances, you may want to receive cash back from your deposit. For instance, if you have a $100 check but only want $80 of it to go into your account and you want $20 back in cash to spend for the week. Another example would be if you are depositing cash and checks but want to receive your cash back in a different amount or denomination. In this example, $50 in the form of a fifty-dollar bill is requested so $50 is entered on the “less cash received” line. When requesting cash back from your deposit, you must sign your name on the signature line.

-

Total Deposit Amount

Now that you have all your cash and checks entered on your deposit slip, it’s time to enter the total deposit amount. Simply add up the total of the cash, the checks listed on the front, and the total from the other side. Then, subtract any cash received, and enter the resulting amount on the “total” line. In this example, the total deposit is $50.50.

The first time you fill out a deposit slip might feel a little confusing but our FNBO tellers and bankers are here to help you.

How to Deposit a Check at an ATM

If you bank with FNBO you have the ability to make a deposit at an ATM. Use our ATM locator to find an ATM near you that will take deposits. You won't even have to fill out a deposit slip, Simply follow the on screen prompts to make your deposit at an atm.

Can You Deposit Cash at an ATM?

Yes. If you bank with FNBO you can deposit cash at one of our ATM's. It may take up to 72 hours for the deposit to show in your account. No need for a deposit slip, simply follow the on-screen prompts to deposit your cash in an ATM.

If you have questions about making a deposit, a Personal Banker from FNBO would be happy to answer them. Give us a call today.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.