FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

Kurt Spieler

Chief Investment Officer

Date Published: August 01, 2018

-

The Bull Market Makes History - Should You Sel

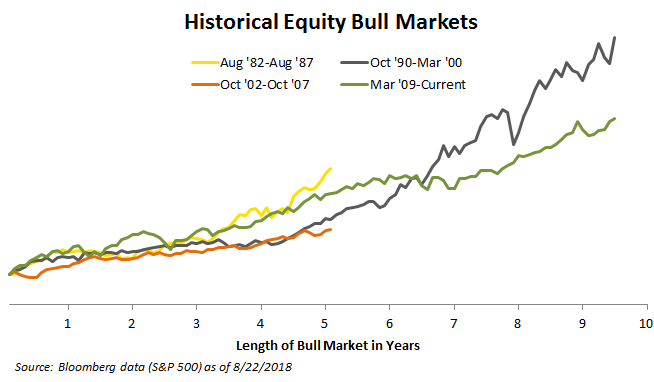

August 22 was a historic day, as it marked the longest bull market in history. The bull market has now turned 3,453 days old, which beats the previous record-breaking bull market of the 1990s. As illustrated, the length and market gains of this bull market are impressive relative to the last four cycles. Even though the current bull market has been around for nine plus years and is close to reaching an all-time high, that doesn’t mean it’s running out of steam.

The current bull run has lasted this long due to the longevity of the current economic expansion. We see a strong correlation between economic growth and stock market returns. The growth in the economy over the past nine years has led to positive company fundamentals and higher equity prices. Low unemployment, modest inflation and low interest rates will likely lead to sustained economic growth, further continuing the bull market. Presently, consumers and businesses are in sound financial condition to increase their spending and investments. Tax reform has also led to an increased capacity for individuals and businesses to spend and invest.

While the market doesn’t show signs of slowing down, it’s difficult to determine how long the stock market rally will continue. However, I believe in the old adage that bull markets don’t die of old age, they end in recessions. The recent acceleration in economic growth provides a cushion and lowers the likelihood of an imminent downturn. The short-term risk to the current bull market is a long and extended trade war with multiple nations. Trade wars often mean higher inflation and lower economic growth. The intermediate-term risk is higher inflation and ultimately higher interest rates, which would result in a downturn in interest rate-sensitive sectors. In addition, individuals and businesses would be spending more to repay interest, leaving less capacity to spend and invest.

Investment research indicates that on average bull markets peak around five months before a recession, which we do not foresee in the near future. Even though we’re in a long bull market and we’re in the historically weaker months of August and September, that doesn’t mean now is the time to sell. When it comes to selling, one of the biggest mistakes people make is trying to time the market. To time the market effectively, you have to make two difficult decisions to add value, as you need to know the best time to sell and when to buy back in. For example, many investors sold in 2008 and never returned to the market, missing out on the 2nd best bull market return in history.

At FNBO, we believe in investing for the long-term, as well as making tactical asset allocation decisions to add incremental value for our clients. Our model is based on the economic outlook, profit outlook and relative valuations, which continue to favor a higher stock allocation. If there were an expected economic slowdown and negative company earnings growth, we would become more cautious on equities. At this point, we don’t believe now is the time to reduce portfolio risk.

The duration of this bull market and all-time highs may be tempting you to sell, but it’s important to stay patient and maintain a long-term perspective. As Warren Buffett says “someone is sitting in the shade today because someone planted a tree a long time ago.”

About FNBO Wealth Management

With FNBO Wealth Management, we focus on diversification, risk-adjusted returns and constructing optimal portfolios. Since 1929, our sole mission has been to help families pursue and achieve their financial goals. We manage $8 billion in assets, allowing us to offer the expertise of a very large investment firm, but with the service and personalized attention of a boutique firm. We use a team decision-making approach for investment strategies and employ 37 experienced investment professionals, 20 of whom hold the Chartered Financial Analyst® designation. Learn more.

About the Author

Kurt Spieler is Chief Investment Officer for FNBO Wealth Management, where he is responsible for developing and implementing investment strategies. This includes leading the asset allocation, equity, fixed income and manager research committees. In addition, Kurt manages investment portfolios for high net worth and institutional clients.

“FNBO Wealth” is a brand name that refers to First National Bank of Omaha (“FNBO”) and certain of its affiliates and subsidiaries that provide or make available trust, investment, securities brokerage, investment advisory, banking, and related services.

This material does not constitute legal, tax, accounting or other professional advice. Although it is intended to be accurate, neither the publisher nor any other party assumes liability for loss or damage due to reliance on this material.