FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Mortgage

Date Published: June 26, 2020

-

Understanding Your Mortgage Statement

Purchasing a new home is an exciting time, but mortgages can be quite mystifying! When do I make my first mortgage payment? Why did my mortgage payment go up? What is included in escrow? New homeowners are often confused when they receive their first billing statement and annual escrow review so we’d like to help. We’ve put together this quick guide, so you will have a better understanding of your mortgage statement and how your loan is serviced.

What does a mortgage statement look like?

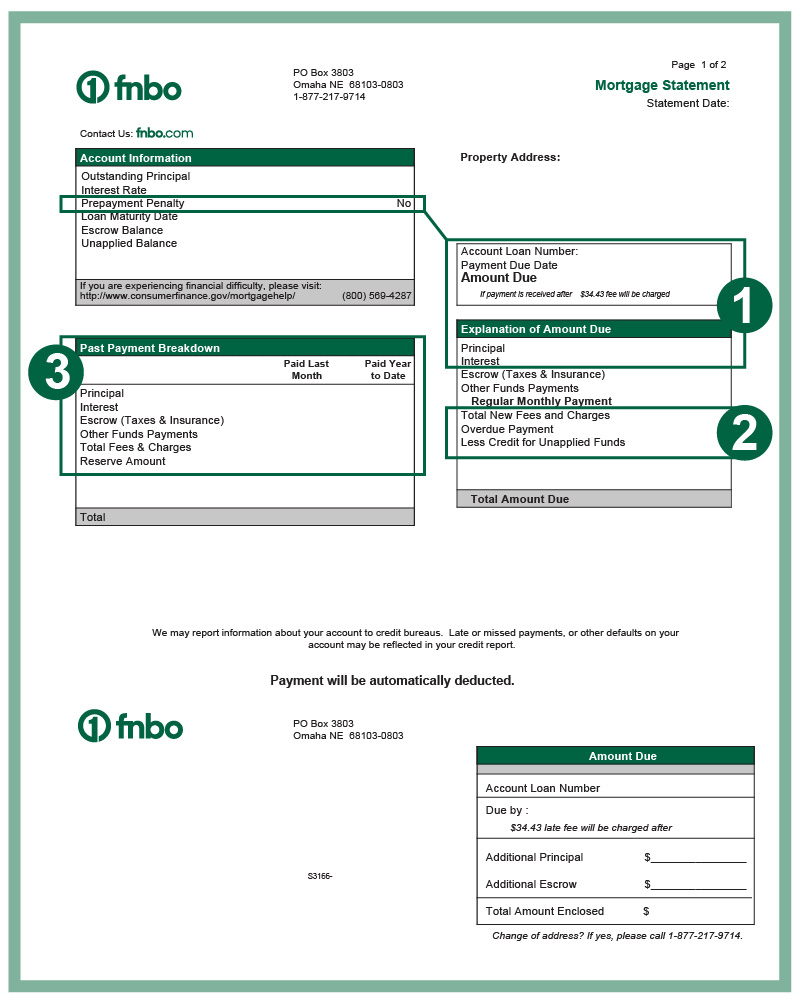

First and foremost, your statement will contain the amount due, clearly showing the principal (what you financed), the current interest rate for your loan, the cost of interest for the period, and whether there are any prepayment penalties. This information will help you to understand where your money is going each month and over the life of your loan, as well as any advantages or disadvantages to paying your home loan off early.

Next, you should see any fees the lender is assessing for the month, such as late charges. If your lender is holding money in escrow for future property taxes and insurance bills, that balance will also be clearly presented on your statement.

Lastly, your statement will show any amounts credited to your loan since the last billing cycle. It’s a good idea to check this section carefully to ensure that your payments are being received and applied correctly, especially if you make additional payments to escrow and/or principal. If your statement shows that your mortgage is delinquent, you should take prompt action to correct the situation to avoid adverse credit reporting.

When is my first mortgage payment due?

Generally you’ll pay your first mortgage payment on the first day of the month following the 30-day period after closing. If you close on June 30th your first mortgage payment wouldn’t be due until August 1st.

Why Did My Mortgage Payment Go Up?

From time to time, a homeowner may be surprised to see that their mortgage payment amount has changed. That’s generally not a problem as long as the payment is going down, but in many cases payments will increase. It is very common with escrowed loans, because property tax and insurance amounts fluctuate. There is no way for a lender to know the exact amount that will be paid-out for property taxes or insurance until after they are paid. All the while, the lender is collecting enough from you to pay property taxes and insurance based upon the last amount they paid on your behalf. Therefore, if taxes and/or insurance increase from what was last paid, you can expect your payment to increase too.

How does an escrow work?

Escrow accounts are reviewed once every 12 months. During this annual review, your lender will compare the escrow activity from the previous 12 months; project all payments to and anticipated disbursements from the escrow account for the upcoming year, and estimate the escrow balance at the end of each month. This review determines if there is sufficient funding in the escrow account for the anticipated disbursements for the next 12 months. A change in your insurance due date or switching to a new insurer could also cause a temporary increase in the amount you owe. Changing to a new company requires you to cancel your old policy, but until that change takes effect, you might temporarily owe both insurers. Fortunately, you should receive a prorated refund on your old policy once the cancelation is complete, and this should help to balance out the shortage once deposited into your escrow account.

Contact your mortgage lender to see if they allow your escrow account to be reviewed outside of the annual escrow cycle to account for any changes that have happened since the last review to keep your shortage and payment increase as minimal as possible. Reviewing your escrow review statement and accounting for the anticipated tax and insurance amounts is vital so you aren’t surprised with an unexpected shortage.

It’s important to understand the factors that could cause your mortgage payment to increase and prepare for those adjustments. Another example would be an adjustable rate mortgage (ARM). With such a loan type, your payment will rise according to the terms. If interest rates are expected to rise it might be the perfect time to refinance your home loan.

What happens if you can’t pay your mortgage?

If you find yourself facing financial hardship due to a payment increase, there are a few things you can do: First, shop around for new insurance. The cost of a homeowner’s policy can change from provider to provider. Shopping around for a lower rate may make enough of a difference in your monthly mortgage payment that you feel comfortable again. Remember to contact your lender to ensure they’ve received the updated information, and to request a new escrow account review because most lenders will only calculate escrow payments during the annual review cycle unless requested.

If you’re still experiencing a financial hardship due to a payment increase, be sure to contact your lender. Some are willing to extend your shortage repayment, or offer forbearance or loan modification if you have a loss or reduction in income. It’s always worth a call to discuss your situation.

What You Need to Know About Loan Servicing

The loan servicer for your mortgage is the entity that sends you statements, collects payments and ensures that any money held in escrow gets paid to the proper sources, such as your insurer or the government office in charge of collecting property taxes where you live. For some, the loan servicer may not always be the financial institution where your loan was originated. Also, the financial institution where your loan was originated may not always be the owner of your debt in the future because loans are commonly sold to investors to provide liquidity for lenders to continue to generate new loans.

How do I find my loan servicer?

There are certainly advantages to having your lender service your loan. For one thing, you can continue to have the same institution take care of your mortgage needs. Even if the originating lender is not the institution servicing your loan, the name and contact information of the current servicer is required on every monthly statement, making it clear and easy to get in touch.

How do you pay your mortgage?

Depending upon your loan servicer, you may have multiple options for making your monthly payment. You can pay online, over the phone, or by mail. FNBO offers the option of paying your mortgage through auto-draft. It’s simple to set up and since payments are automatically drafted from your account on each draft date, you don’t have to worry about late or missed payments or accruing any associated penalties. Plus it’s free!

Enjoying Your New Home

Purchasing a home is one of the biggest investments you will probably ever make. Understanding the information on your statement and annual escrow review, as well as how your loan is serviced, will help you successfully plan for a financial future that ensures happy days in your home for years to come.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.