FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO Newsroom

Date Published: May 01, 2023

-

Press Release

Contact: Sally Christensen, 402-871-1933

Release Date: May 1, 2023

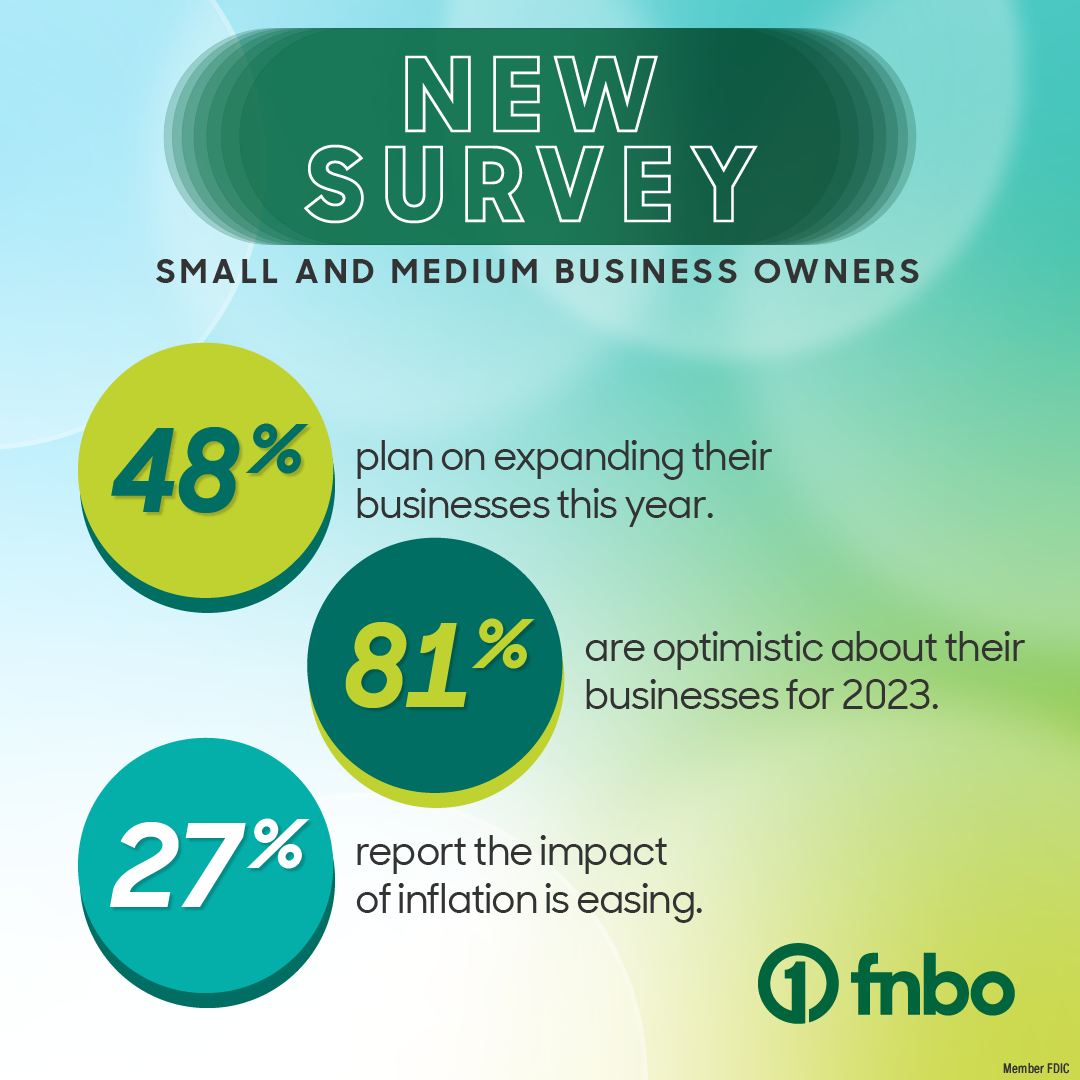

Study: Almost Half of Small and Medium Business Owners Plan on Expanding their Businesses in 2023

-2023 Small and Medium Business Survey Data Released by FNBO-

PLUS: Nearly One-Third Say the Impact of Inflation On Their Business is Easing

OMAHA, Neb. May 1, 2023 — First National Bank of Omaha (FNBO) today released the results of its 2023 Small-Medium Business Survey, which examines the state of small to medium-sized businesses—covering a range of timely topics from hiring to inflation to optimism for 2023 and more.

Amid uncertain economic conditions, 67% of small to medium business owners are not expecting an economic recovery by 2023. Additional data reveals 35% say they expect a recovery in 2024, and 32% say 2025 or later.

THE GOOD NEWS: 81% of small to medium business owners say they are optimistic about their business for 2023. Additionally, 48% plan on expanding their businesses this calendar year.

“Through all the obstacles over these past few years, and the uncertainty that still remains, business owners across the country have, time and time again, proven to be nothing short of resilient, dynamic and determined,” said Laura Nelson, senior vice president, Small Business, FNBO. “It is encouraging to see the extent to which small to medium business owners are optimistic and primed for growth through 2023. The grit and ingenuity of the small to medium business owner—combined with smart financial planning and goal setting—paves the way for long-term success.”

Among the survey’s additional findings:

- 2023 Plans and Priorities: For the rest of 2023, 48% of small to medium business owners plan on expanding their business, however 65% share the sentiment that that, ‘today it is more challenging than ever to run a business,’ and only one-fourth (27%) would encourage others to start their own business. Additionally, 22% of small-medium business owners plan on adding to their employee counts this year.

- Employment Trends: 78% of small to medium business owners say hiring is more challenging now than ever before. Additionally, 27% of business owners identify finding quality talent as the number one thing that would help their businesses.

- Top Challenges: Regarding the top challenges impacting their businesses, 41% of small to medium business owners say the general state of the economy, 19% say finding new customers, 19% say hiring issues.

- Inflation Impacts: When asked about the impacts of inflation 27% report that it is easing, and 19% identify the impacts as not significant.

- Millennial Business Owners: Out of the small-medium business owners who are millennials, a resounding 87% say they are optimistic about their business for 2023. Additionally, 31% of millennial business owners identified finding quality talent as the number one thing that would help their business.

This is the latest survey from FNBO’s Small-Medium Business series.

METHODOLOGY

This survey was conducted online using Survey Monkey among a national sample of 852 small to medium business owners spanning U.S. geographic regions and income levels. Nearly 61% of FNBO’s survey respondents said they were local businesses employing 10 or less employees. The survey sample was weighted to reflect the gender distribution and the age distribution across the 18-44 and 45+ age brackets in U.S. census data.

About FNBO

First National Bank of Omaha (FNBO) is a subsidiary of First National of Nebraska. First National of Nebraska, Inc.. (FNNI). FNNI and its affiliates have nearly $30 billion in assets and 5,000 employee associates. Primary banking offices are located in Nebraska, Colorado, Illinois, Iowa, Kansas, South Dakota, Texas and Wyoming. Founded in 1857, FNBO has maintained its commitment to helping build strong communities for more than 165 years. Learn more at FNBO.com and connect with us on Facebook, Twitter and Instagram.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.