FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Personal Finance

Date Published: August 28, 2025Originally Published: October 29, 2020

-

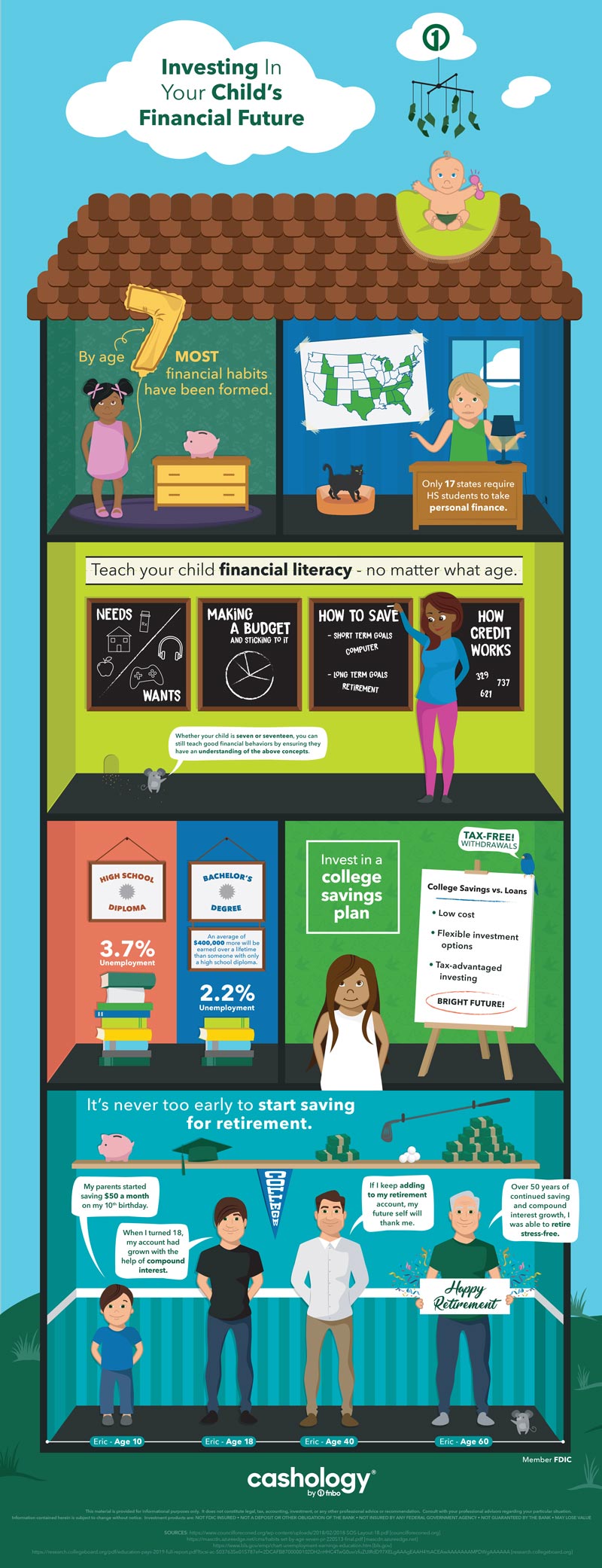

Investing in Your Child's Financial Future

Three tips for financial health in adulthood

As parents, we try to do all of the right things for our children to ensure they have a successful and healthy adulthood. We instill the importance of a healthy diet, getting plenty of exercise and the value of good grades. One thing we often overlook is the importance of financial health. Teaching financial literacy and providing our children with the tools for financial success are equally as important as physical health and educational excellence. By following these tips, you will help secure a healthy financial future for your child.

Teach your child financial literacy.

We send our kids off to school with the confidence that they are being taught the necessary academic skills such reading, writing and mathematics. When it comes to financial education, we can’t be so sure. According to the 2018 Survey of the States, conducted by the Council for Economic Education, a mere 17 states require high school students to take a course in personal finance. Therefore, the majority of our children are graduating without basic financial skills regarding saving, budgeting, and managing credit. The survey also states that children equipped with these skills are more likely as adults to have an emergency savings fund and save for retirement, and are less likely to carry personal debt or use high-cost methods of borrowing.

It’s clearly up to parents and guardians to teach financial literacy to our children, and the sooner we start the better. According to researchers at Cambridge University, by the age of seven, most financial habits have been formed. Don’t despair – whether your child is seven or seventeen, you can still teach good financial behaviors by ensuring they have an understanding of the following concepts:

1. Needs vs. Wants: Needs are things you need to survive such as food, certain medications, shelter, etc. Wants are things you’d like to have but don’t need to survive. Having an understanding of how these two concepts differ will help your child create an effective budget. Teaching your child that needs are paid for first and wants second will help them prioritize their spending, creating good financial habits.

2. Making (and sticking to) a budget: A budget is a plan that shows the total amount of money earned in a time period such as a week or month, and how much of that money will be spent, and on what. Understanding how to manage a budget will increase your child’s ability to live within their means, save for the future and decrease their chances of turning to high-interest credit to make ends meet.

3. How to Save: Saving is simply the act of putting money away for future use, whether it is for a short-term goal such as a new computer, or a long-term goal such as retirement. Saving can be taught at any age. Follow these tips to get your child to start saving immediately. Then, be sure to have them open a savings account where their hard earned money will be kept safe and possibly grow.

4. How credit works: Using credit is not always a negative thing and good credit scores are necessary to purchase a home, buy a car or sometimes to get a job. Teaching children why credit is important, how to obtain credit and how to keep credit in good standing will ensure they use credit as a financial tool rather than a crutch. And it will help them achieve financial well-being.

Invest in your child’s education with a tax-deferred college savings plan.

Your child will need a well-paying job in order to earn money and put those financial skills to work. Obtaining a college degree or another form of higher education can make a significant impact on their financial security in the long-run. According to the Bureau of Labor Statistics, the unemployment rate of those with a high school diploma was 3.7 percent in 2019, compared to just 2.2 percent for those with a bachelor’s degree. Plus, bachelor’s degree holders can earn $400,000 more over a lifetime than those with only a high school diploma, based on College Board’s Education Pays 2019 report.

Higher education, however, comes with a cost and you don’t want your child to begin their adult years burdened by student loans. By investing in a tax-deferred college savings plan, you can save for virtually any type of accredited two- or four-year school, including public or private universities, community colleges, and vocational or trade schools—even graduate schools in the United States and abroad.

Each state sponsors their own college savings plan which offer varying features and benefits that can save you money in the long-run. However, you aren’t limited to investing in your home state’s plan. You can research which plans are the best fit for you based on affordability, flexibility, tax advantages, investment diversity, etc. and invest in any plan you choose.

Another thing to consider is it’s simply cheaper to save now than to borrow later. Take for example, an education cost of $48,000. If you were to invest $150 per month into a college savings plan that earns an annual return of 7% compounded interest, at the end of 15 years your total out of pocket cost to reach $48,000 is $27,000 due to the interest earned on your investment. However, if you were to take out a loan to cover the $48,000 education cost, and paid it off over the course of 15 years at a 3.50% interest rate, your total out of pocket cost would be $61,766. That’s a $34,766 difference! Of course, the earlier you get started, the better—but it’s never too late.

Start saving for your child’s retirement. *

Saving for your child’s retirement may seem like a crazy concept, especially since you may just be getting started with your own retirement savings. But due to the compounding effects of interest, just a small amount set aside each month for your child now (whether you make the contributions yourself, or invest money that your child earns on their own), could add up to a comfy sum when they retire. For example, if you started putting $50 per month into an investment account on your child’s 10th birthday and continued until they turned 18, assuming an eight percent rate of return, they would have $6,655 in their account. If they left that money in the account, without adding another dime, 40 years later they would have $144,576! Then assume that your child continues what you started but increased their monthly contribution to $100 a month for the next four decades. At the end of 40 years they will have accumulated $468,757 in savings! That’s a considerable chunk of change to help them retire.

With a little diligence, investing in your child’s financial future can become as instinctual as nurturing their physical health and educational excellence. At FNBO, we have the tools that can help guide you along the way. A Personal Banker can assist you or your child in setting up a savings account and one of our Wealth Advisors can help you with your investment choices. Call a branch today!

An investor should consider the investment objectives, risk, and charges and expenses associated with municipal fund securities before investing.*

Investment Products Are Not FDIC Insured • May Go Down in Value • Not a Deposit • Not Guaranteed By the Bank • Not Insured By Any Federal Government Agency.

This material does not constitute legal, tax, accounting or other professional advice. Although it is intended to be accurate, neither the publisher nor any other party assumes liability for loss or damage due to reliance on this material.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.